「穩定幣」是 2025 年在全球金融領域備受矚目的關鍵字,它不僅擁有改變全球資金流動方式的巨大潛力,更有機會讓「金融平權」在地球每一個角落得到徹底落實。

從 10 幾年前第一款穩定幣 USDT 誕生,走到今日「穩定幣大爆發」的新時代,全球各國,尤其以美國為代表的監管政策與態度,扮演了至關重要的催化劑角色。

看好穩定幣的發展與應用,XREX 集團也連續三年在新加坡舉辦亞洲最大的穩定幣高峰會 Stablecoin Summit!每一年,全球在穩定幣領域重要的產業領袖與專家,都會齊聚一堂,討論當下最重要的穩定幣議題與趨勢。

究竟穩定幣帶給人類社會哪些重要的價值?在美國通過了監管穩定幣的《天才法案》之後,全球穩定幣產業的下一步是什麼?

XREX 共同共同創辦人暨集團執行長黃耀文 Wayne 在 Stablecoin Summit 2025 的開場演說中,以「穩定幣作為一種數位不記名貨幣」Stablecoins as Digital Bearer Money 為題,從貨幣數位化的起點、數位不記名貨幣的優勢、穩定幣與悠遊卡之異同,一路談到對於穩定幣的兩項未來觀察。以下是 Wayne 在 Stablecoin Summit 2025 演講的中英文逐字稿。

開場|Introduction

All right, good morning. Thank you so much for making it. I can’t believe you guys made it in such an early morning session.

My name is Wayne. Today I’ll be talking about “Stablecoins as Digital Bearer Money”, which I feel is stablecoin’s core innovation and its full potential.

好的,大家早安。非常感謝各位特地撥冗前來。這是一個非常早的場次,非常佩服台下在場的各位,都能夠這麼早到。

我是 Wayne,今天我要談的主題是:「穩定幣作為一種數位不記名貨幣」,我認為這點是穩定幣創新的核心,以及它背後真正的潛力。

網路的黎明到來、當錢開始全球化:數位貨幣演進史|The Dawn of the Internet and the Globalization of Money: The Evolution of Digital Currency

So how did we digitize money? In the 90s, once the internet demonstrated that we can send information in real time and we have the freedom to publish and access information, the money transfer industry started to imagine how we could digitize money.

我們如何將貨幣數位化呢?在 90 年代時,當時網際網路的出現,讓人們可以即時傳輸資訊,以及擁有自由發布和取得資訊的能力,於是金流業者開始思考,究竟該怎麼將金錢也數位化。

So that we can send money like how the internet sends data. But we didn’t try to digitize paper bills. Instead, we created closed-loop money ledgers.

如此一來,我們就能像在網路上傳輸資料一樣的傳送金錢。但我們當時並不是試圖將紙鈔數位化,取而代之的是,我們建立了封閉式的貨幣帳本(closed-loop money ledgers)。

With remittance and payment products like Venmo, Paytm, WeChat, WeChat Pay, Alipay, and M-Pesa, we started to move money at internet speed.

透過像是 Venmo、Paytm、微信、微信支付(WeChat Pay)、支付寶(Alipay),以及 M-Pesa 這些匯款與支付服務,我們開始能夠以網路的速度來轉移金錢。

This digital money model breaks when servicing a global user base. Licensing, reporting, and audits per jurisdiction made universal onboarding very difficult, and the post-911 AML requirements made opening an account a compliance challenge.

然而,一旦要服務全球的使用者時,這些數位貨幣模式就出現挑戰。由於每個國家和區域有自己的監管與法規,也有不同的申報和稽核要求,這使得全球使用者難以使用同一款產品。再加上美國 911 事件後實施的反洗錢(AML)規定,要符合法規要求開立帳戶變得更加困難。

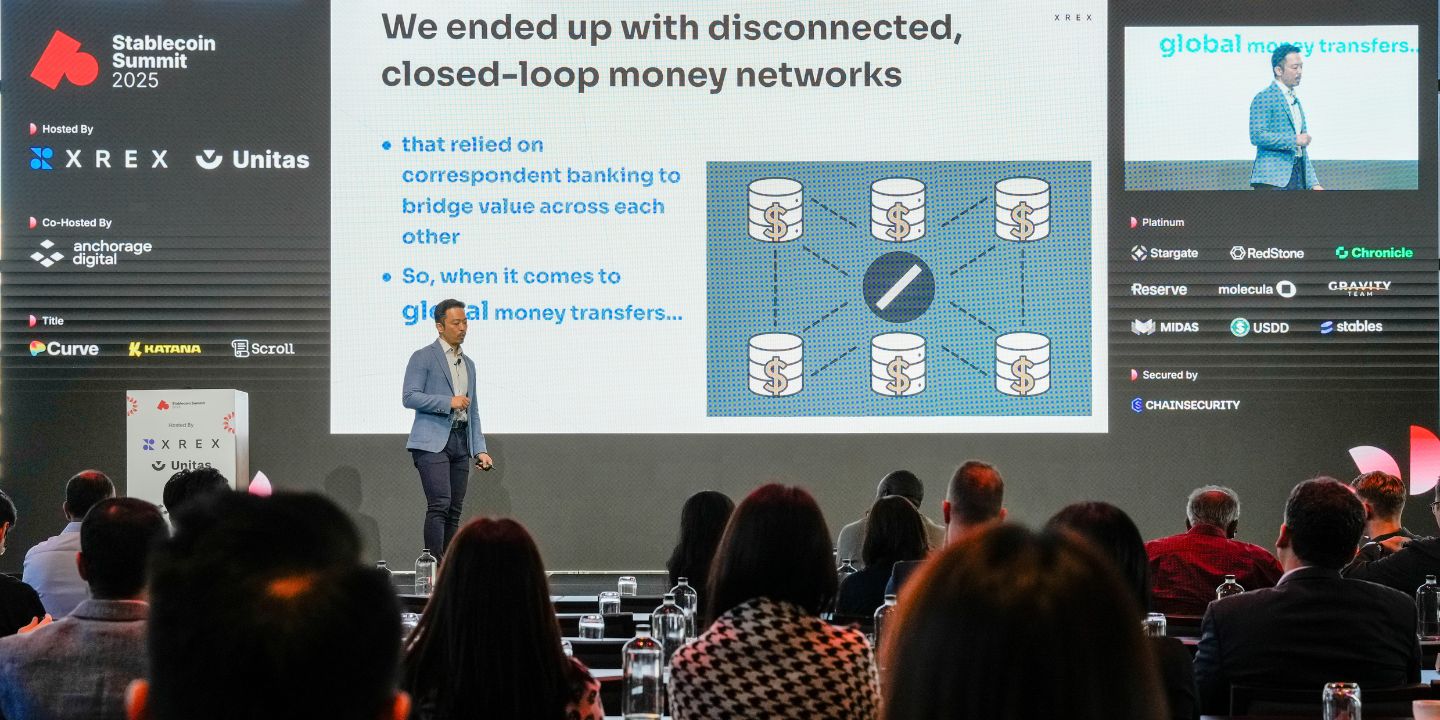

So we ended up with disconnected, closed-loop money networks that relied on correspondent banking to bridge value across each other. And we had a lot of vostro and nostro accounts.

最後,我們得到的是一個斷裂且封閉的金錢網路,必須仰賴通匯銀行 / 代理行(correspondent banking)進行價值轉移。同時,我們也產生了大量的代存帳戶(Vostro,客戶的銀行在你的銀行開的帳戶)和他行的代存帳戶(Nostro,你的銀行在別家銀行開的帳戶)。

Why? Because money was permissioned private ledgers, and it was based on a trust model. So when it comes to global money transfers, we never really had a fast global network.

為什麼會這樣?那是這樣的錢是一本「需要許可」的「私人帳本」,而且是基於信任的基礎在運作的。因此,在全球資金轉移上,我們從未真正擁有過一個快速的全球網絡。

持有即擁有?看懂數位不記名貨幣的優勢|Possession as Ownership? Understanding the Advantages of Digital Bearer Assets

So what if we didn’t digitize money using closed-loop ledgers? What if we tried to digitize paper bills? What’s special about paper bills? Well, the paper bill is a bearer instrument. Possession is finality, and verification is against the bill, okay? Not the holder.

那麼,如果金錢數位化不使用封閉式帳本,會是什麼景象?如果我們嘗試將實體紙鈔(paper bills)數位化呢?紙鈔有什麼特別之處?紙鈔就是一種不記名工具(bearer instrument)。只要持有,交易或所有權就已是最終定論(Possession is finality),即使要驗證,也是驗證紙鈔本身,而不是持有者。

So with a bearer instrument, we don’t care who the holder is. Anybody can hold it. We just care if that bill is genuine and has value. And whoever is in possession of that bill has the right to spend it and is the owner of it.

所以,對於不記名工具來說,我們不需要在意誰是持有者。任何人都可以持有。我們只在乎那張紙鈔是否為真且具有價值,而無論是誰持有這張紙鈔,都擁有使用它的權利,就被認定為其擁有者。

So paper bills offer better financial sovereignty. Why? Anyone can hold it using any container, right? So if it’s paper cash, if I have hands, I can hold it in my hands, or hold it in my wallet. I can put them in safes regardless of my nationality and jurisdiction, and no one needs an account. That is the financial sovereignty that paper bills can enable.

所以,紙鈔提供了更好的金融自主權(financial sovereignty)。為什麼?因為任何人都可以用任何方式和載具來持有它,對吧?如果它是紙鈔,我有手就可以把它拿在手上、放在皮夾裡,或者存放在保險箱中,完全不受我的國籍和司法管轄區的限制,也不需要開立帳戶。這就是紙鈔所能實現的金融自主權。

So we asked what’s the best technology to digitize paper coupons and make it easy for people to access them, authenticate them, and detect counterfeits. What’s the technology? Thank you, Sergio. Of course, it’s the blockchain.

因此我們想問:「要將紙本票券數位化,並讓民眾能輕鬆取得、驗證真偽,以及檢測偽冒品,哪種技術最適合?」是什麼技術?(Wayne 向台下觀眾發問)。

台下觀眾答:「區塊鏈。」

感謝 Sergio(答題的觀眾)!當然是區塊鏈。

So we created the first fast global money transfer network, and we moved from disconnected closed-loop networks of database ledgers to tokenized cash on permissionless blockchains with tokens that anyone can hold and send, and where no account issuance is required.

因此,我們打造了第一個快速的全球資金移轉網絡,成功從過去斷裂且封閉的資料庫帳本網絡,轉變為在無需許可的區塊鏈上發行代幣化現金(tokenized cash),透過這些憑證,任何人都可以持有、發送,而且完全不需要開戶就能使用。」

臺灣經驗:悠遊卡與穩定幣有何關係?|The Taiwan Experience: The Connection Between the EasyCard and Stablecoins

When asked about the GENIUS Act, Mr. Dong—he is currently the director of the Taiwanese Central Bank and also the chairman of Megabank, a major bank in Taiwan—said Taiwan had a similar payment product almost 20 years ago, and that attracted some scrutiny.

當被問及《天才法案》(GENIUS ACT.)時,目前擔任臺灣央行常務理事,同時也是兆豐銀行董事長的董先生(董瑞斌)日前曾表示,臺灣在近 20 年前,就有過類似的支付產品,這段發言引起了一些關注。

But I really feel that there’s a lot of truth in what he said because he referred to EasyCard, which was available since 2002, more than 20 years ago, as the digital top-up card for mass transportation payment. And because it needs to be servicing payments for mass transportation, think about buses, MRTs, and trains. The goal was inclusive access.

我真的覺得他(董先生)說得有部分是對的,因為他指的是悠遊卡(EasyCard)。

悠遊卡自 2002 年起發行,至今已超過 20 年,這是一張用於大眾運輸車資支付的數位儲值卡,由於它的服務範圍必須涵蓋公車、捷運和火車等大眾運輸工具的車資支付,因此其核心目標,就是要能普及化使用(inclusive access)。」

So it was designed almost like a digital bearer instrument.

Anyone, regardless of nationality, can use it. So it doesn’t matter if you’re from a sanctioned country, as long as you can get yourself to Taiwan and you’ve got paper cash, you can use that paper cash, go to a convenience store, and buy yourself an EasyCard. You can pay anywhere and with any mass transportation system in Taiwan. So, no KYC and no account issuance is required. And you top up with paper cash.

所以,悠遊卡的設計理念幾乎就是一種數位不記名工具,不論國籍,任何人都可以使用它。也就是說,就算你來自一個受到制裁的國家也沒關係,只要你能進入臺灣,並持有紙鈔現金,就能拿這些現金到便利商店購買一張悠遊卡。之後,就可以在臺灣任何地方支付,並使用於所有大眾運輸系統。不需要經過 KYC(實名認證) 流程,不需要開立帳戶,且可以直接使用紙鈔加值。

It received the electronic stored value card license in 2010. That’s the ESCVC license in Taiwan. And this license, again, requires no KYC and no account issuance. And expanded to become the most popular payment product in Taiwan. That’s an EasyCard, okay. And I think that’s what Mr. Dong meant when he said, “Oh, stablecoins. Well, we had a similar regulatory regime more than 20 years ago in Taiwan.”

悠遊卡在 2010 年取得了電子票證 / 電子儲值卡許可證(Electronic Stored Value Card license),也就是臺灣的 ESCVC(電子票證) 執照。這個許可證同樣不要求用戶 KYC(實名認證)和開立帳戶。隨後,悠遊卡擴展成為臺灣最受歡迎的支付產品。這就是悠遊卡的故事。

我認為這就是董先生在提到穩定幣時所說的意思,他說:「喔,穩定幣啊?我們臺灣早在 20 多年前就有類似的法規制度了。」

新時代序幕:當人們不再將穩定幣賣回法幣|The Prelude to a New Era: When Stablecoins Cease to Be Cashed Out for Fiat

Similarly, stablecoins are a financial inclusion booster because they enable access to the currencies people need or prefer. The world trade currency is the US dollar. Lots of people and businesses need access to the US dollar, and stablecoins gave them that option. And today, people in emerging markets use them for both B2B cross-border payments as well as for person-to-person retail remittances.

同樣地,穩定幣也推動了普惠金融,因為它們能讓使用者取得各自需要或偏好的貨幣。美元是全球貿易的主要貨幣,許多人及企業都需要使用美元,而(美元)穩定幣就提供了這個選項。

在今天,新興市場的民眾利用穩定幣,不僅用於企業之間(B2B)的跨境支付,也用於個人之間(P2P)的私人匯款。

Stablecoins are becoming a better alternative to correspondent banking. They have become a more efficient means to move value between two financial institutions, and they significantly reduce pre-funding and in-transit capital. So now we don’t need all these nostro-vostro accounts.

穩定幣正逐漸成為通匯銀行(代理行)模式更好的替代方案。並已成為兩家金融機構之間轉移價值的更有效方式,大幅減少了所需的預先注資和在途資金。因此,我們現在不再需要這麼多的我方行存(Nostro)和代存(Vostro)帳戶了。

The FIs are starting to use stablecoins. But stablecoins are not only a better settlement technology. Lots of people say, “Oh, it’s only a better settlement technology. Lots of people say, “Oh, it’s a better settlement technology than Swift.” They’re not only that. Because stablecoins are becoming a form of digital bearer money, right?

金融機構(FIs)已經開始使用穩定幣。不過,穩定幣不只是一種更好的結算技術而已。很多人說:「喔,它只是一種比 SWIFT 更好的清算技術。」但穩定幣不只是這樣。因為穩定幣正成為一種數位不記名貨幣,對吧?

When you receive an MT-103 telegram from Swift, that is not money itself. You have to go through correspondent banking to move that value. But when you receive stablecoins, stablecoins are by themselves digital bearer money, and so it’s not only a settlement technology.

當你收到 SWIFT 的 MT-103(電子訊息或指令) 電報時,電報本身並不是錢。你必須透過通匯銀行(correspondent banking)才能轉移背後的價值。然而,當你收到穩定幣時,穩定幣本身就是一種數位不記名貨幣。因此,它不單單只是一個結算技術。

A stablecoin achieves its ultimate potential when users start to believe it’s money, and not just a settlement instrument. And they stop selling back to fiat. They start to hold it, and start to transact with it.

當使用者開始相信穩定幣就是錢,而不僅僅是一種結算工具時,它才能實現其終極潛力。屆時,人們將停止將穩定幣兌換回法幣,而是開始持有它,並直接用它來交易。

為什麼流動性就是信任?|Liquidity is Trust—But Why?

When you receive a new stablecoin, you’d say, “Well, you know, I’m not comfortable until I settle it back to dollars, until I have dollars in my bank account. Well, today, many stablecoins are seen as money themselves. So we receive a stablecoin, we say, great, it’s settled, I’m going to hold it, I’m going to pay someone else with it. This belief needn’t be in the issuer, but rather in the stablecoins secondary market liquidity.

當你收到一個新的穩定幣時,你可能會說:「你知道嗎,在把穩定幣結算換回美元、直到我的銀行帳戶裡真正有美元之前,我都還不太放心。」

然而今天,許多穩定幣已經被視為錢。所以,當我們收到一個穩定幣時,我們會說:「太棒了,交易已經結清了!我打算持有它,然後再用它去支付給別人。」這種信任不一定要建立在發行方身上,而是來自於穩定幣的二級市場流動性。

This is when a stablecoin truly takes on a life of its own. So we say, “Liquidity is trust,” and it’s when stablecoins become money. So although we digitized money a long time ago, with stablecoins, we used permissionless blockchains to create digital bear money, and in my opinion that is the core stablecoin innovation.

這就是穩定幣真正施展潛力的時刻,所以我們說「流動性就是信任」(liquidity is trust)。這就是穩定幣成為「錢」的時刻。雖然我們很久以前就開始將金錢數位化了,但透過穩定幣,我們利用無需許可的區塊鏈技術來打造數位不記名貨幣。在我看來,這才是穩定幣的核心創新所在。

穩定幣的兩大觀察與未來展望|Two Observations and the Future Outlook for Stablecoins

Moving forward, I’d like to share two observation points from me following the GENIUS Act.

接下來,我想分享兩點我對「後《天才法案》」(Genius Act)時代的觀察。

One, a lot of people, including financial institutions, banks, and regulators, come and ask us about issuing new stablecoins, especially local currency-pegged stablecoins (non-US dollar-pegged stablecoins).

第一, 有很多人、許多金融機構、銀行和監管機構,前來詢問我們新發穩定幣的事情,特別是關於與當地貨幣掛鉤的穩定幣,也就是非美元掛鉤的穩定幣。

My opinion is there are only two stablecoin markets. Really, you have the US dollar stablecoin as one huge market, and then the rest of the stablecoins. Okay, so when thinking about the stablecoin business, really we’re looking at two very different markets: the US dollar stablecoin and the rest. Because the US dollar remains the dominant medium of exchange and unit of account. That’s number one.

我的看法是,穩定幣市場只有兩個:一個是龐大的美元穩定幣市場;以及其他的穩定幣。

當我們在思考穩定幣業務時,我們確實是在看兩個截然不同的市場:美元穩定幣市場和其他穩定幣市場。這主要是因為,美元依舊是主導市場的交易媒介和計價單位,這就是第一個觀察。

And two, the issuer revenue can’t be forever based on floats, right? So we’ve had long stretches of history where the short-term interest rates were close to zero. Now it’s very high, yes, and issuers are getting great revenue, but throughout history, it wasn’t like this. Also, in 2024, 91% of PayPal’s revenue came from fees, not float.

第二點,穩定幣發行者的營收,不能永遠只依賴浮動資金(float,即客戶資金在結算期間或尚未被動用時,發行方或銀行可用於投資賺取利息的資金),對吧?。

我們過去曾有很長一段時間,短期利率都接近於零。雖然現在利率非常高,發行方因此能獲得豐厚的收益,但在歷史上,情況並非總是如此。此外在 2024 年,支付公司 PayPal 有 91% 的營收來自手續費(fees),而不是浮動資金。

So what does this mean? Well, okay, so who’s making the fees today? If the issuers are making their revenue from floats, it’s the blockchains, right? Messari reports that over the past few quarters, wallet-to-wallet transfers and stablecoins account for more than 95-98% of transactions on Tron, for example. And Paolo also shared recently that amongst the nine blockchains, Ethereum, Tron, Ton, Solana, 40% of fees are paid to send USDT.

這意味著什麼?今天誰在賺取手續費?如果發行方的收入是來自於浮動資金,那麼賺取手續費的就是區塊鏈網絡了,對吧?

根據 Messari 過去幾季的報告,例如在 Tron 區塊鏈上,錢包對錢包的穩定幣轉帳,佔了該區塊鏈整體交易量的 95% 到 98% 以上。Paolo (Tether 執行長)最近也分享,在以太坊、Tron、Ton、Solana 等九個區塊鏈之中,有 40% 的手續費是用來支付發送 USDT 的。

So today, the business model is such that issuers are making their revenue from float while most of the fees go to the blockchains. But if short-term rates won’t stay elevated and payments typically monetize via fees and not float, think about PayPal last year, would stablecoin issuers start to grow their affiliated blockchains to build a more robust revenue model in preparation for the possibility that the revenue from floats may eventually decrease?

所以今天,(穩定幣的)商業模式是發行者從浮動資金中賺取收入,而大部分手續費則流向了區塊鏈網絡。但如果短期利率無法一直維持在高位,而且支付服務通常是靠手續費,而非浮動資金來變現的,想想去年的 PayPal,那麼穩定幣發行商,是否會開始發展自己的區塊鏈,來建立一個更穩健的收入模式,以應對浮動資金收入最終可能減少的情況?

So these are my two observations. There you have it! Stablecoins as digital bearer money that stablecoin core innovation and their full potential. Thank you very much.

這是我的兩點觀察。以上就是我對「穩定幣作為數位不記名貨幣」的分享,有關穩定幣的核心創新及其潛力。

非常感謝大家。

關於 XREX 集團

創立於 2018 年,XREX 集團是一家擁有區塊鏈技術的國際金融機構,與銀行、政府及用戶密切合作,共同改寫金融定義。

XREX 集團將普惠金融視為社會責任並希望為此盡一份心力,持續運用區塊鏈技術推進金融參與權、金融使用權與金融教育權。

XREX 集團新加坡子公司於 2024 年 5 月取得新加坡金融管理局 (MAS) 大型支付機構 (MPI) 執照,臺灣子公司鏈科股份有限公司則於 2022 年 3 月,完成與臺灣金融監督管理委員會 (金管會) 的洗錢防制法令遵循聲明,並於 2025 年 9 月 22 日通過金管會的洗錢防制登記,爲通過的九家合規虛擬資產服務商之一。