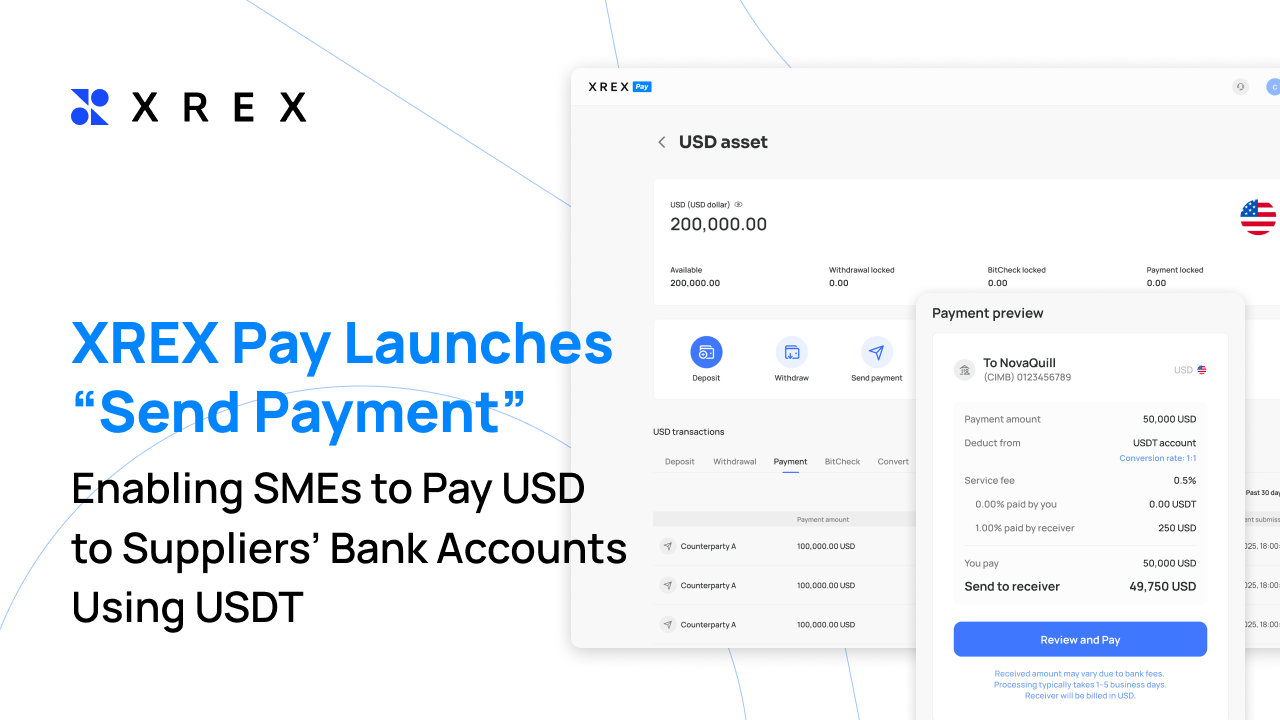

XREX Pay officially launched its new feature, ‘Send Payment,’ on 29 December 2025. The feature enables enterprise users, including small and medium-sized enterprises (SMEs), to initiate US Dollars (USD) bank transfers to third-party bank accounts funded either by USD or the stablecoin (USDT), subject to applicable verification, screening, and settlement processes. This feature is designed to support businesses that hold USD and USDT, and require USD bank transfers to counterparties that do not accept digital assets, within a regulated and compliance-aligned payment framework.

In emerging markets, businesses face difficulties in maintaining USD-denominated banking arrangements or managing cross-border settlements. As a result, stablecoins like USDT have become an important payment tool, especially for merchants engaged in cross-border trade. However, using USDT alone can be challenging, since many counterparties continue to require payment in USD to bank accounts. XREX Pay’s “Send Payment” feature allows eligible XREX Pay users to fund USD bank transfers using supported balances, including USDT, while ensuring that payment execution occurs through established banking channels and in accordance with applicable regulatory requirements.

Seamless Payments Across USD and USDT with XREX Pay

UNCTAD and IMF reports indicate that 30–40% of countries experience chronic USD shortages, turning USD from a simple medium of exchange into a scarce strategic asset. XREX Pay, a cross-border B2B payment platform supporting both fiat and stablecoins, was launched in September 2024 and operates under a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS) to address these systemic trade barriers.

XREX Pay enables corporate users, including SMEs to conduct cross-border B2B transfers, hold and manage multiple currency balances, and access regulated settlement pathways between digital payment tokens and traditional currencies. With the new ‘Send Payment’ feature, users can manage accounts payable more efficiently, leverage fully compliant bidirectional settlement gateways, and integrate on-chain assets with traditional financial infrastructure—strengthening both operations and competitiveness for their global businesses.

Bridging the USD Liquidity Gap for Global SMEs

With Send Payment, XREX Pay users can decide how to pay: 1. Initiate USD bank transfers directly from their USD balance held with XREX Pay to a recipient’s bank account, 2. Fund USD bank transfers using USDT balances subject to applicable conversion, screening, and settlement processes.

For corporate users without a US Dollar account or those unable to obtain sufficient USD, Send Payment is an ideal solution for executing international B2B payments via established banking rails, including SWIFT, and are processed in accordance with the timelines and procedures of the recipient’s bank.

Why XREX Pay?

- Verified third-party payouts: Counterparty identity and bank account details are subject to verification prior to payment execution.

- Compliant, document-backed payments: Payments are supported by required trade documentation and are subject to transaction monitoring and screening in accordance with applicable AML/CFT and know-your-transaction (KYT) requirements.

- Seamless USD/USDT transactions: Users may fund USD-denominated bank transfers using supported USD or USDT balances, with official payment confirmations provided to both sender and recipient.

How to Send Payment with XREX Pay?

Step 1: Counterparty Bank Account Verification

To meet regulatory and operational requirements, counterparty’s bank account details must be verified before first payment. The verification steps are as follows:

- Select Send Payment from quick action on the Homepage

- Click add counterparty bank account

- Submit the counterparty and bank account information in accordance with the on-screen instructions

- You will receive a notification email once your application is approved

Step 2: Execute Payment using USD or USDT

Once the counterparty’s bank account details are verified, the payment execution process is as follows:

- Select Send Payment from quick action on the Homepage

- Select a verified counterparty bank account to which you wish to make the payment

- Complete the payment details and upload required supporting documentation in accordance with the on-line instructions

- Both the sender and the recipient will receive an email notification once the payment has been successfully paid out

Payments are sent via SWIFT, and receipt is subject to the processing timelines of the recipient’s bank.

How Much is the Service Fee?

Transactions on XREX Pay are subject to a 0.5% service fee based on the total payment amount, with a minimum fee of USD 60 per transaction. Fee allocation may be designated as payable by the sender, payable by the recipient, or shared equally between both parties, as selected at the time of submission. The minimum payment amount is USD 100, with a maximum limit of USD 3,000,000 per transaction, subject to applicable limits and compliance requirements.

Business Payments, Flexible in USD or USDT

As digital payment tokens are increasingly used by businesses for cross-border settlement and treasury management, interoperability between digital payment tokens and traditional banking systems has become operationally important. Such interoperability enables businesses to integrate digital assets into existing payment and settlement processes within regulated frameworks.

XREX Pay’s Send Payment feature supports this interoperability by enabling USD-denominated bank transfers funded by supported digital payment token balances, including USDT, subject to applicable verification, screening, and settlement procedures.

By operating within established regulatory safeguards and conventional banking infrastructure, XREX Pay supports businesses in managing cross-border payments in a compliant and operationally efficient manner.

About XREX Group

XREX Group is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide services to businesses in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

XREX Singapore operates under the Major Payments Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). XREX Taiwan is a regulated VASP that completed its Compliance Declaration on Anti-Money Laundering (AML) with Taiwan’s Financial Supervisory Commission (FSC) in March 2022. It passed its AML registration with the FSC in September 2025, becoming one of nine approved VASPs.