Originally published in May 2022, under CommonWealth Magazine’s Wayne Huang’s Mandarin column: “LUNA crashed 99%, how did the third-largest stablecoin UST shock Yellen with its death spiral?”

When people look back on 2022, it will be impossible to not mention the shock stablecoin UST has created in the crypto market.

As UST, the third-largest stablecoin, lost its dollar peg in April, it triggered a massive sell-off leading to Terra Luna’s value plummeting. LUNA, which was once worth over $100, crashed 99% within two days, trading lower than $1. This collapse wiped off $28 billion from the market, shocking the world.

On May 7, 2022 at midnight local time, UST suddenly lost its 1:1 peg to the US dollar and an anonymous player dumped nearly $200 million worth of UST. Some believe this was a concerted attack on UST, taking advantage of Terra’s commitment to move UST from their existing liquidity pool 3pool to its new 4pool, entirely draining UST liquidity and panicking the market.

This article lays out the rise and fall of Terra, including a timeline of this attack.

On May 8, Terra co-founder Do Kwon woke up to a normal day. He teased his followers on Twitter and asked the market to stay calm while he slept as his family had just welcomed a newborn. However, UST continued to lose its dollar peg, trading at a ratio of 1:0.3, forcing Luna Guard Foundation (LGF) to sell out its 70,000 Bitcoin reserves (worth $2.1 billion at the time) in an attempt to rescue its stablecoin. This immediately led to a fall in the crypto market, creating turbulence and instability. As UST and LUNA continued losing value, the LGF’s assets to salvage the ecosystem were rapidly depleted.

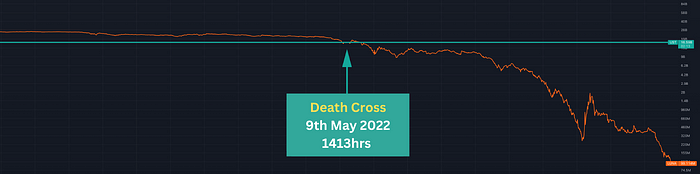

On the afternoon of May 9, LUNA’s value plummeted from $41 billion to less than $16.6 billion, creating a death cross that resulted in a crush of LUNA and UST.

On May 10, US Secretary of the Treasury Janet Yellen also commented on the UST drop to US Senators, “We see run risks, which could threaten financial stability, risks associated with a payment system and its integrity and risks associated with increased concentration if stablecoins are issued by firms that already have substantial market power,” Yellen said. “We definitely see significant risks.”

As the effects of this catastrophe persist, one cannot help to ask, “Is there any chance for UST, once the world’s third largest stablecoin next to USDT and USDC, to make a comeback? Is it possible for UST to regain its dollar peg even after suffering from a death spiral that led to its rapid fall? What are the takeaways from this crypto chaos?

The three generations of stablecoin

UST was launched in 2020 September and categorized as the third generation of stablecoin, also known as algorithmic-coin. Before the UST meltdown, there had already been much news on stablecoins de-pegging, including UST founder Do Kwon’s failed project Basis Cash, Polygon’s safedollar cyber incident last year, and Beanstalks Farms’ flash load attack in April

None of these, however, compares to the shock UST’s fall has sent throughout the global crypto market, considering its great value and reputation.

Before diving into UST’s depeg crisis, we must first look into the development of stablecoins.

Stablecoins are currently categorized by their form of collateral structure. Since Tether launched the first USDT in 2014, stablecoins have undergone three iterations depending on the assets that they are used to stabilize their value, including centralized stablecoin, decentralized stablecoin, and algorithmic stablecoin.

The First Generation: Centralized Stablecoin

As the name suggests, centralized stablecoins are issued by centralized institutions, such as USDT, USDC, and BUSD which are issued by Tether, Circle, and Binance respectively.

Since centralized stablecoins maintain a reserve of fiat currency (most often the US dollar), they are also known as fiat-collateralized stablecoins. It is only decentralized on the shared ledger while maintaining a centralized operation and decision-making process.

This type of stablecoin requires the issuer to have an equivalent amount of collateral. In other words, one must deposit $1 as collateral to mint one stablecoin. This 1:1 ratio ensures the stability and dollar peg value of the coin, allowing the holder to convert the coin into dollars anytime.

Second Generation: Decentralized stablecoin

Decentralized stablecoins such as Dai are overcollateralized via crypto assets to maintain stability and are facilitated through smart contracts.

The collateralization ratio for DAI is set above 150%; its liquidity ratio is 150%. This means that depositing $150 worth of Ether allows one to borrow up to 100 Dai (roughly equivalent to $100). If the collateralization falls below $150, the Ether will automatically liquidate to ensure the system’s solvency and its dollar-peg value.

Strictly speaking, the above mechanisms have only allowed DAI to be loosely pegged to the dollar. It was not until the end of 2020 that DAI secured its value when DAI adopted USDC as its main reserve (over 50%) and implemented the peg stability module (PSM) that allowed a direct swap for USDC at a 1:1 rate.

The Third Generation: Algorithmic stablecoin

Algorithmic stablecoin differs from former stablecoins since it doesn’t apply collateral backing. Instead, it maintains its value through algorithms that can dynamically regulate its supply and demand.

For Terra’s UST, investors must burn an equal value of LUNA to mint UST. As Terra’s native token, LUNA is used for governance, transaction fee payment, and staking. This means that UST is not backed by any collateral but by an arbitrage mechanism — the UST’s price is regulated by its supply; those who own LUNA can redeem an equivalent amount of UST. LUNA serves to control the supply of UST in the market and stabilize its price.

Exogenous and Endogenous Factors

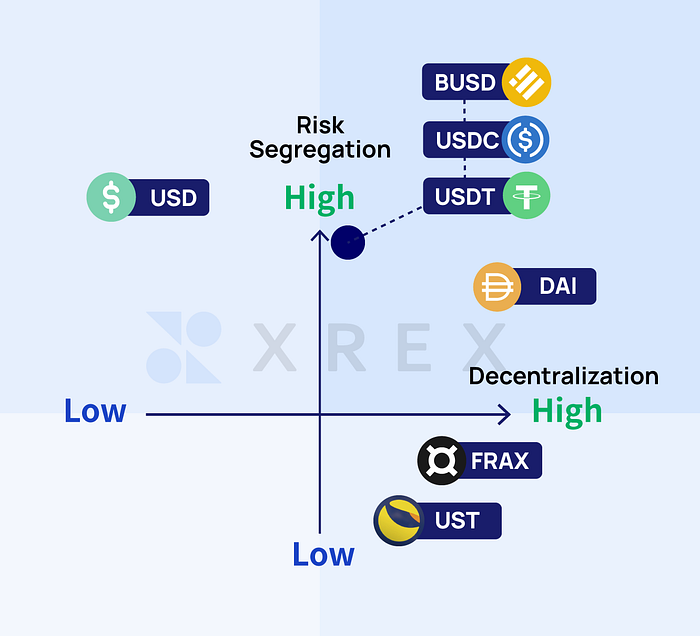

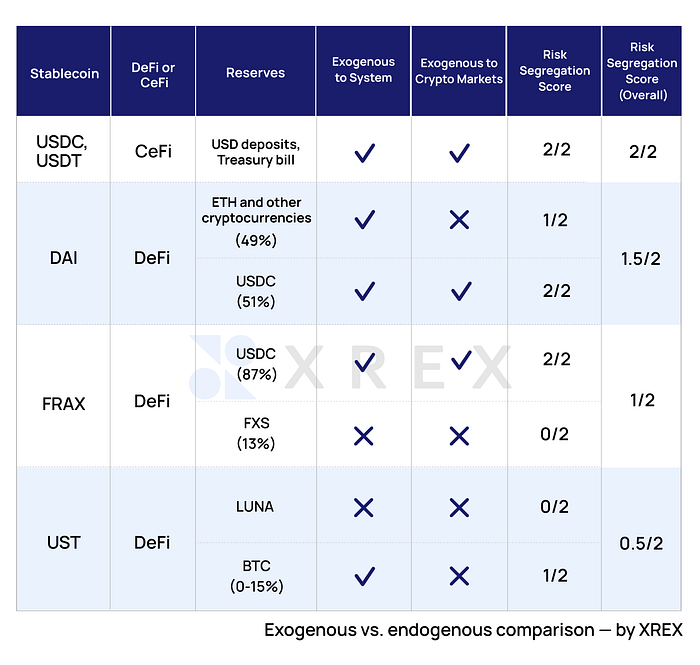

The author believes that instead of dwelling on the algorithm or collateral, discussing the exogenous and endogenous factors of the incident would offer readers a better picture of how UST lost its peg and what sent it into a death spiral.

In plain language, the terms exogenous and endogenous simply refer to whether a risk is linked to other risks and if there are flow-on effects between them.

As previously mentioned, there are three types of stablecoins with different collateral structures. By factoring in exogenous and endogenous elements, one can further identify whether the risks these different collateral structures face have flow-on effects with other risks.

Here is an example for illustration:

Say X decides to use government bonds as collateral to take a loan from a bank. The bond’s value is irrelevant to X’s company performance; hence the government bond is an exogenous factor. On the other hand, if X decides to use his or her company stock as collateral and the company’s earnings drop, the company’s stock will also fall due to X’s inability to repay. In this case, X’s company stock price is what we refer to as an endogenous factor.

Stablecoins have a similar rationale. The second generation of stablecoin DAI has respectively 50% of USDC and 50% of ETH backing. USDC is not only an exogenous factor to DAI but also to the crypto market since it is backed by USD cash and US bonds. DAI’s two collaterals — ETH and USDC — serve to stabilize its value and shelter it from volatility because they are less prone to be affected by outside risks.

In other words, the quality of the stablecoin’s reserve asset and its linkage with the ecosystem is conclusive when the crypto market is volatile. Despite being criticized for being too centralized, DAI’s 50% of USDC backing helps it keep a distance from the crypto market and secure its dollar peg. The other 50% of the reserve of cryptocurrency such as ETH — despite having more market-associate risks — offers the benefits of decentralization.

The reason why UST fell into a death spiral was mostly caused by endogenous factors. UST is backed by Terra’s native coin LUNA; the value of LUNA tokens is built on the use of UST and the market’s confidence and demand for UST — leading to a dangerous and contradictory situation. LUNA is closely correlated with the crypto market and directly associated with the UST ecosystem. Even with its rich reserves, it is too vulnerable to exterior risks. What’s worse, there was no mechanism in place to stop this feedback loop, creating a vicious cycle where the market’s loss of trust led to further shocks.

To ward off associated risks, LGF acquired over $1 billion in Bitcoin as reserve. Though Bitcoin is an exogenous factor to the UST ecosystem, this amount of Bitcoin reserve was insufficient to save the peg. In the process of dumping Bitcoin, LGF tanked the Bitcoin price which resulted in a massive UST sell-off.

This ended in a debacle: UST lost its dollar peg, dragging LUNA’s price. As people lost faith, UST and LUNA entered a death spiral. The rapid Bitcoin sell-off led to a seismic shock in the crypto world and a global disaster that could not be salvaged.

From the above examples, one can conclude that to hedge risks, a stablecoin must be backed by collateral that is exogenous and possess enough of its reserve to prevent liquidation risk. If the stablecoin and its collateral are endogenous, there will be a flow-on effect between the risks.

Takeaways from the UST Crisis

Since its debut in 2014, stablecoins have gone through three evolutions in eight years. As transactions and payments of stablecoins democratize, increasingly more countries are perfecting relevant regulations.

We can foresee more variants of stablecoins coming into existence, leading to a market full of competing and diverse options. The development and application of cryptocurrencies are still in the early stage. Both governments and industries are still growing through innovations and learning lessons from failures. We have three takeaways from the recent UST crisis:

- Reserve diversification and exogenous factors are significant to stablecoins.

- Blockchains allow the potential of birthing a new generation of currency issuers.

- We should institutionalize a proper stablecoin monitoring mechanism as soon as possible.

Reserve diversification and exogenous factors are significant to stablecoins

Compared with the previous two generations of stablecoins, UST has progressed in market efficiency. However, as UST relies on the burn-and-mint equilibrium, if the system has not reached maturity, it can be overwhelmed under the pressure of panic-selling when investor confidence collapses.

Additionally, as reserves backing is an endogenous factor, and UST is pegged with LUNA, they fell tremendously altogether, failing to provide hedging effectiveness. Accordingly, after the UST de-pegging, future stablecoin issuers would need to consider reserve diversification. Take UST as an example: Linking UST with LUNA is putting all eggs in the same basket. When the market is unstable, it will be difficult to manage risk and prevent a crisis from happening.

Blockchains allow the potential of birthing a new generation of currency issuers

Traditional monetary systems usually lack transparency when crises erupt. On the contrary, when UST collapsed, whoever was interested in the matter could observe changes in the liquidity pool, reserves, wallet swaps, circulation, transactions, pledges, etc., on the blockchains, noting the fluctuations and actions taken by stakeholders. None of them would be possible without blockchains.

Even though the collapse of UST created a shockwave and the process was brutal, everyone could bear witness to the entire situation, including reactionary measures as well as responses from both the market and the coin issuer. Simply put, both currency issuers and the minting mechanism of coins are forced to be more transparent.

We should institutionalize a proper stablecoin monitoring mechanism as soon as possible

Last November, the President’s Working Group on Financial Markets (PWG) released a report on stablecoins. Back in March, US President Joe Biden also signed an executive order demanding that the authorities concerned to evaluate the risk and benefits of cryptocurrencies and digitized US dollars.

You can find more information in my previous column, “The Road of Crypto Regulation in the US and Why Crypto Executive Order Is a Historical Milestone”

US Treasury Secretary Janet Yellen also stood on the frontline when the UST crisis occurred, introducing UST and briefing the issue to the House and the Senate. From these recent developments, we can see that the United States is urgently concerned about monitoring stablecoins. Investors for either UST or LUNA suffered a significant loss in this crisis. Many mom-and-pop investors lost all their assets.

The warning given by Under Secretary for Domestic Finance, Nellie Liang, proved to be true in this incident. Do stablecoins have high-quality liquid assets to stabilize and back their value in the face of panic-selling and market collapse? You can refer to our previous column, “High-Quality Liquid Assets: Tether reduces its cash reserves, but there’s more than meets the eye” for further reading.

Nobody wanted to see UST unpegged, which is the most catastrophic disaster for stablecoins.

Nevertheless, we learned a lesson from such bloodshed and a terrible death spiral. It would prompt us to pursue a more optimized design and mechanism for stablecoins and to further positive and sustainable monetary reformation for all.

Written by: Wayne Huang, 尤芷薇, Andrew Chen, Aditya Gupta