Consumer-to-consumer (C2C) cross-border money transfer is defined as “Remittance”. In general terms, a remittance is a payment of money that is transferred to another party. Broadly speaking, any payment of an invoice or a bill can be called a remittance. However, remittance is most often described as any sum of money being transferred by an overseas worker/student to his/her family back in their home country.

The two most common ways of making a remittance are by:

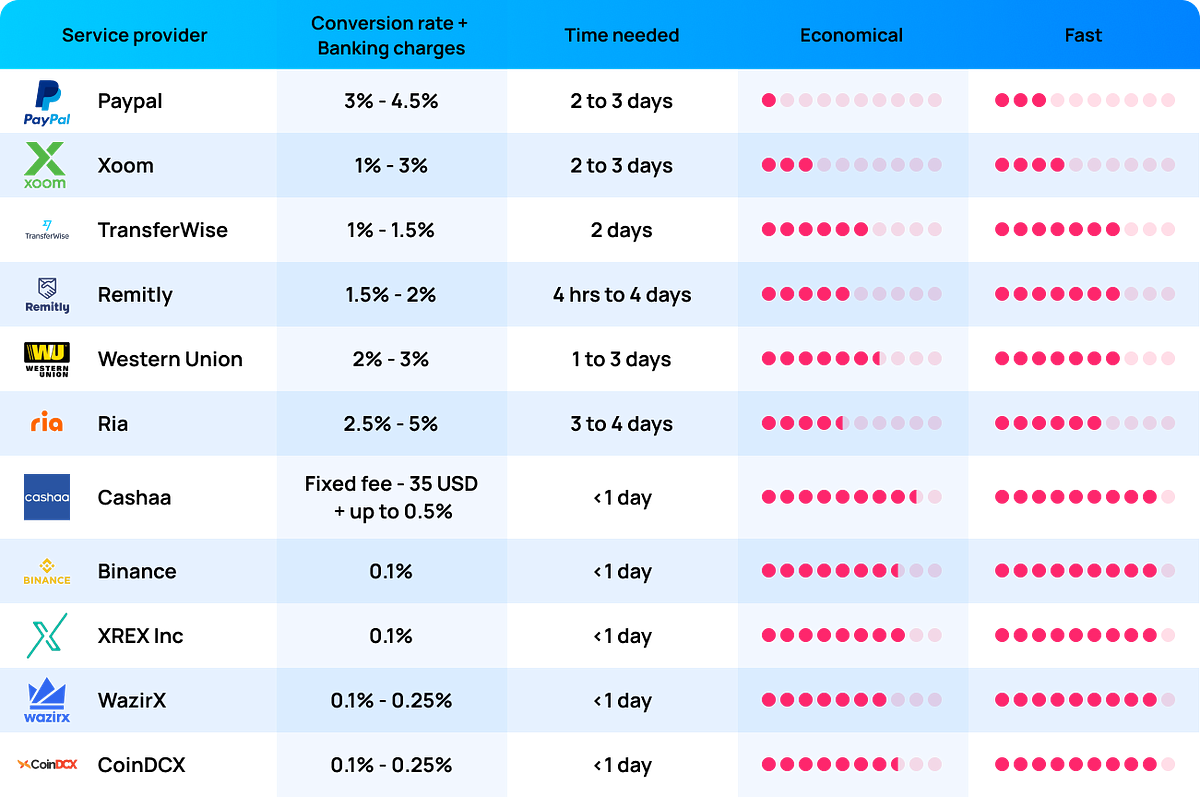

- Using an electronic payment system via bank or by companies like Transferwise, Remitly, Paypal, or Xoom.

- By depositing cash with the agent of a remittance company like Western Union, Ria or Moneygram, etc for sending money to their beneficiary directly.

It cost you up to 6% to send money to India and other developing countries.

India is the biggest country for receiving inward remittance. In 2019, India received close to 80 billion US dollars, equivalent to 590,000 Crore Indian rupees, from Indians living abroad. A considerable amount, roughly between 1.5 to 6% as shown in the table below, is lost due to bank charges, conversion fees, and remittance charges.

A practical study led by the team from Coincrunch found out that sending cryptocurrencies instead of USD is not only cost-saving but much faster and secure compared to sending USD directly by traditional banking systems or remittance providers.

The advancements of fintech combined with the growing acceptance of crypto as a monetary value or means of transferring value can reduce global remittance costs drastically. While Bitcoin remains the most well-recognized and globally accepted crypto, it might not necessarily be the best and only option to use for sending remittances.

What are stable coins and the implications?

Stable coins are cryptocurrencies that are backed 1:1 with fiat money like USD or SGD. Stable coins function as stable currencies in the crypto space and the acceptance of USDT or USDC or BUSD over the last couple of years is a testament to the growing acceptance of these in global payments.

Many startups are utilizing the benefits of crypto to solve the long-existing remittance problems. For example, XREX, backed by world-class cybersecurity experts with 14 years of experience, has launched its SaaS solution MyXchange to streamline the operations for money service providers and money transfer operators. Not only for corporations and institutions, but MyXchange also empowers individuals to play a role in the global money service.

XREX Positioning & Proposition

Top security, escrow service, strict identity verification, and anti-money laundry policy make XREX a trustworthy and competitive option in the global remittance market using crypto. By partnering with domestic money transfer companies and licensed local partners like Oxymoney, XREX solves last-mile delivery challenges in the complex Indian market along with complying with the existing laws of the land.

In conclusion, in the coming years, Bitcoin and cryptocurrencies will become the best alternative to send money to India and other developing countries, where people are now paying huge fees while sending money home. Crypto solutions can lower down the cost significantly and speed up the delivery for global remittance.