Hidden Costs Behind B2B Cross-Border Payments

For global enterprises, managing cross-border B2B payments has long been a trade-off between cost, speed, and trust. Despite decades of fintech innovation, international payments remain slow, opaque, and expensive. The global economy may move in real time, but money often does not. According to data from the European Central Bank (2023) and EY Global (2024), the average corporate international transfer still incurs around 1% to 1.5% in transaction fees, even as fintech adoption expands.

Furthermore, every transfer triggers reconciliation, compliance screening, and manual verification. Finance departments and professionals spend valuable hours ensuring payments are not lost in transit or held up by intermediary banks. For companies operating on tight margins, such as manufacturing, this inefficiency compounds over time, eroding profitability and creating friction in supplier relationships.

📍More to Explore:Empowering Gig Economy and Global Labor Mobility with Instant Cross-Border Payouts: XREX Pay

Why Traditional T/T and D/P Methods Fall Short

For decades, telegraphic transfer (T/T) and documents against payment (D/P) have been the backbone of cross-border trade. Yet both systems reflect an era where paper, not data, defined trust. T/T offers speed but minimum protection: the buyer wires funds and simply hopes the supplier ships on time. D/P provides supplier protection, but at the cost of agility. Documents must pass through multiple banks and clearinghouses before goods are released. Every intermediary adds delay, cost, and uncertainty.

These inefficiencies have measurable consequences. Visa’s 2024 research shows that cross-border B2B payments take 55% longer to settle than domestic ones. During these waiting periods, goods sit idle in warehouses, balance sheets distort, and cash flow tightens. Buyers fear overpaying; sellers fear not getting paid. Trust is scarce, and every transaction feels like a leap of faith.

📍More to Explore:Streamlining Cross-Border Payments for Importers and Exporters: XREX Pay

XREX Pay: Escrow Confidence Meets Fintech Speed

At XREX Singapore, a major payment institution licensed by the Monetary Authority of Singapore (MAS), we designed XREX Pay to simplify and secure cross-border transactions for corporate clients. BitCheck, a blockchain-enabled escrow solution built directly into XREX Pay, delivers the reliability of traditional trade finance with the speed and transparency of fintech.

The process is intuitive. The buyer creates a BitCheck by depositing funds — USD or USDT — into an XREX Pay account, which can then be used to set up an escrow payment. The supplier immediately sees proof of funds, confirming that payment exists and is ready for release. Once goods are shipped or contractual terms are fulfilled, the buyer authorizes instant release of funds to the supplier. There are no third-party intermediaries like banks, no document delays, and no ambiguity. XREX Pay’s BitCheck transforms trade finance from paperwork into programmable trust—executed within minutes on a secure, MAS-regulated platform.

For the supplier, BitCheck provides assurance of payment before shipment; for the buyer, BitCheck ensures accountability and control over fund release. Because XREX Pay operates under the MAS regulatory framework, both parties enjoy compliance-grade protection.

📍More to Explore:Better Liquidity and Faster Settlement for Payment Service Providers (PSPs): XREX Pay

Cost Efficiency and Real-World Savings

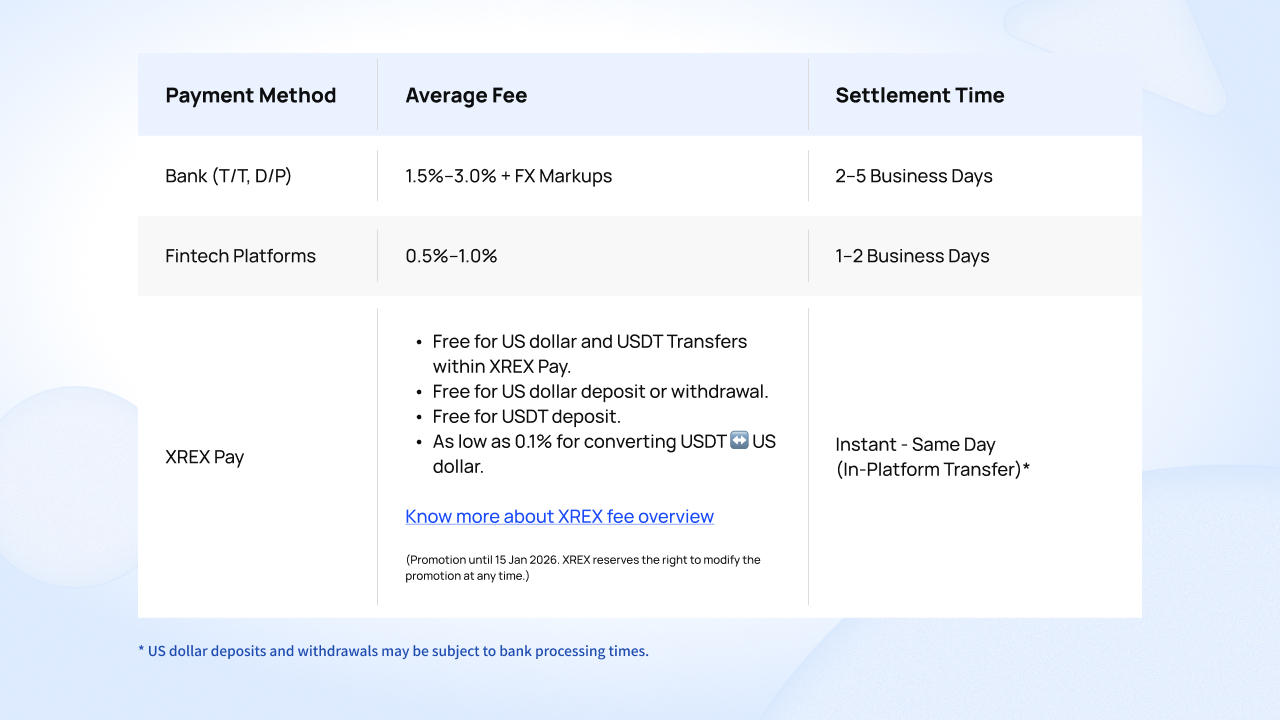

XREX Pay’s economic proposition is equally compelling. Until 15 January 2026, all USD deposits and withdrawals are free, and transfers between XREX Pay users—whether in USD or USDT—carry no charge.

The only fee applies when converting between fiat and cryptocurrencies, as low as 0.1%. This is a fraction of what most banks or fintechs charge. For businesses processing high-value payments, this difference translates directly into higher margins and better cash management. XREX Pay is your trusted payment partner in accelerating business success in the global market.

The Future of B2B Payments: Low Fees, High Trust, and Transparent Compliance

The global B2B payment landscape is changing fast. In 2024, total cross-border B2B transactions surpassed USD $31.7 trillion and are projected to reach USD $47.8 trillion by 2032 (FXCintel.com). XREX Pay represents a new model for this new era — enabling low-cost, instant, and verifiable transactions that balance efficiency with compliance. By embedding modern fintech capabilities within a regulated environment, XREX Pay supports both fiat and stablecoins and removes the friction that has long hindered cross-border settlements.

For businesses, adopting XREX Pay isn’t just about cost reduction. It’s about redefining how global trade partners collaborate. Escrow-backed payments build credibility across borders, empowering both small and medium-sized enterprises (SMEs) and multinationals to transact confidently and securely. XREX Pay delivers a unified multi-currency infrastructure built on cost efficiency, speed, and trust.

Enterprises looking to streamline their global payment operations can take the first step today — fill out the inquiry form to connect with a designated XREX relationship manager and explore escrow-backed, low-cost settlement solutions tailored to your global business needs.

About XREX Group

XREX Group is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide services to businesses in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

XREX Singapore operates under the Major Payments Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). XREX Taiwan is a regulated VASP that completed its Compliance Declaration on Anti-Money Laundering (AML) with Taiwan’s Financial Supervisory Commission (FSC) in March 2022. It passed its AML registration with the FSC in September 2025, becoming one of nine approved VASPs.