Global payment in 2025 is increasingly interconnected, yet payment systems remain fragmented, costly, and inefficient — especially for small businesses and emerging markets. Stablecoins are digital assets pegged to fiat currencies, offering a promising blend of stability and blockchain efficiency. In this article, we delve into why stablecoins are gaining momentum, how regulatory clarity and application cases are reshaping cross-border payments.

1. Why Stablecoins are Redefining Global Payments in 2025

Cross-border payments are projected to reach USD $320 trillion by 2032, rising from approximately USD $200 trillion recently (ECB). Traditional remittances often incur fees averaging 6.4% for USD $200 transfers — well above the United Nations’s 3% sustainable target (FXC Intelligence).

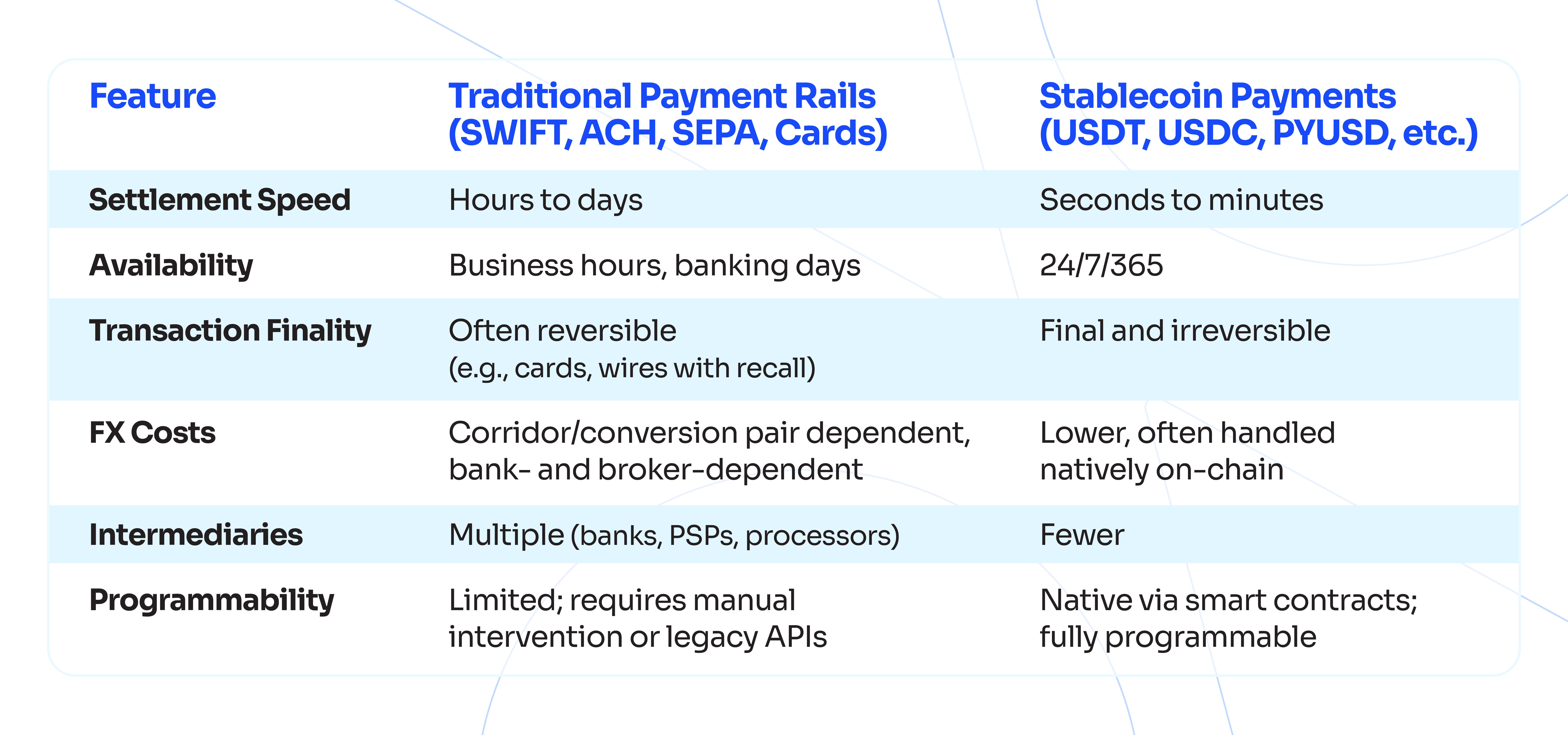

Stablecoins present a powerful alternative:

- Lightning-fast settlements: Cross-border transfers complete within minutes via blockchain rails — versus two to five business days using traditional methods such as SWIFT.

- Reduced fees: Transaction costs typically range from 0.1%–0.3%, substantially lower than remittance fees (6-10%).

- Greater accessibility: Emerging economies benefit from stablecoin adoption through mobile wallets, enabling broader access to financial services and addressing traditional banking system limitations.

(Source:Fireblocks)

In 2025, stablecoins are transitioning from niche experiments to foundational tools for efficient, inclusive cross-border commerce.

📍More to Explore:Empowering Gig Economy and Global Labor Mobility with Instant Cross-Border Payouts: XREX Pay

2. Global Trend Toward Stablecoin Regulation: Building Trust Through Policy

Stablecoins have quickly moved beyond their origins as a niche within the crypto ecosystem to become a foundational element of global finance. Today, stablecoins are not only used for payments and remittances, but also play an increasingly important role as collateral and as a trusted store of value. What makes this growth even more significant is that increasingly more governments around the world are moving to establish regulatory frameworks for stablecoins, providing the legal clarity and oversight needed to build trust and drive broader adoption.

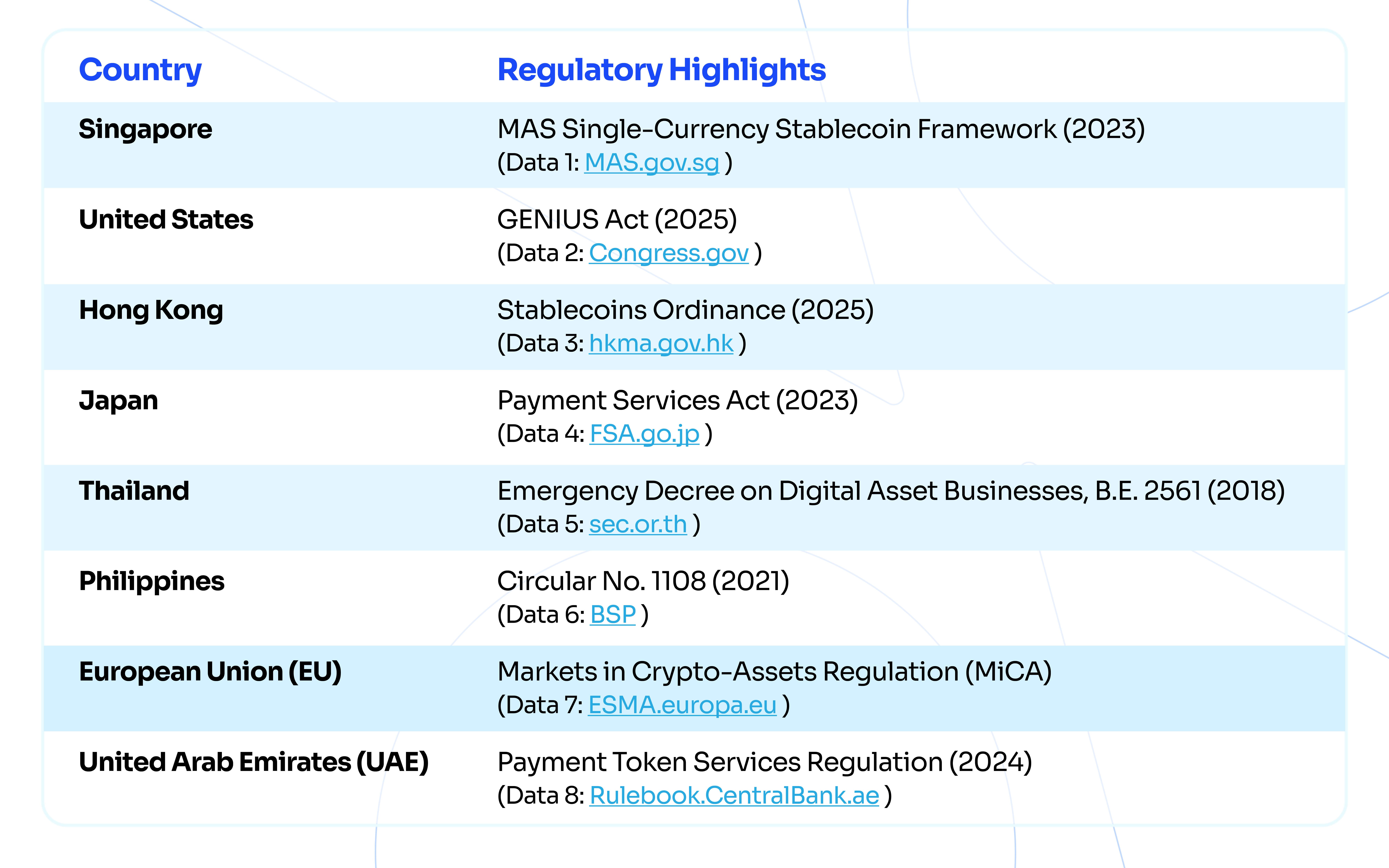

The following table highlights selected regulatory updates related to stablecoins across different jurisdictions:

(Data 1:MAS.gov.sg ; Data 2:Congress.gov ;Data 3:hkma.gov.hk;Data 4:FSA.go.jp;Data 5:sec.or.th;Data 6:BSP;Data 7:ESMA.europa.eu;Data 8:Rulebook.CentralBank.ae)

Across those countries listed above, financial regulators are increasingly examining how stablecoins should be governed. Although regulatory approaches differ—some are drafting rules under digital asset legislation, while others are considering integration into central bank payment frameworks and AML/CFT regimes—there is a growing alignment on key priorities: financial stability, consumer protection, and AML/CFT compliance. This reflects a shift in how governments are approaching stablecoins: moving away from treating them solely as unregulated crypto assets and toward exploring their potential role in payments, cross-border transfers, remittances, and enterprise settlements—provided that appropriate regulatory safeguards are in place.

3. Stablecoin Adoption in Cross-Border Payments: Case Studies from SMEs, Gig Platforms, and Importers

Singapore – Company A (SME Exporter)

By choosing stablecoins, Company A—a Singapore-based SME exporter—significantly streamlined its payment process. In the past, each international shipment involved waiting up to 48 hours for bank settlements, with foreign exchange costs eating into margins.

After adopting stablecoins, Company A reduced FX costs by 1.5%, and shortened settlement times from 48 hours to under 30 minutes. This not only lowered costs but also allowed Company A to ship goods more quickly and strengthen buyer relationships through faster, more reliable payments.

Southeast Asia – Company B (Gig Economy)

Company B, a regional gig economy platform, faced challenges paying thousands of freelancers spread across multiple countries. Traditional bank payouts often required two to three business days, with fees reducing take-home pay and creating frustration among workers.

After adopting stablecoins, Company B reduced payout times by 50% (from two days to same-day transfers) and cut administrative overheads by 25%. Workers now receive near-instant payments, leading to higher satisfaction and platform loyalty. It also gained a competitive edge by offering more reliable income access compared to rivals still relying on banks.

Latin America – Company C (Distributor)

Company C, a mid-sized distributor, often lost value waiting for banks to open before converting USD receipts into local currency. Regional currency volatility meant a typical delay could result in ~3% FX losses.

By converting local currencies to stablecoins immediately, Company C preserved that value and accessed liquidity faster. This shift provided greater predictability in cash flow and shielded the company from sudden devaluations.

Across Latin America, 54% of firms have live stablecoin integrations; 75% report increasing customer demand for such options (Fireblocks).

These three cases demonstrate how stablecoins are no longer a speculative tool, but a practical financial solution. From lowering FX costs and enabling near-instant settlements to protect against volatile currencies and improving worker satisfaction, stablecoins deliver measurable business benefits. What unites these examples is the ability to replace traditional banking bottlenecks with faster, cheaper, and more predictable payment rails, directly strengthening competitiveness in international markets.

4. How Businesses Can Begin Using Stablecoin Cross-Border Payments

As stablecoins gradually transition from experimental tools to regulated financial infrastructure, enterprises interested in adoption must distinguish between entry steps and ongoing operational considerations. Success requires a clear path to entry and a framework that ensures trust, security, and scalability.

(1) Getting Started: Partner with a Licensed and Trusted Provider

Select a payment provider that is fully licensed and compliant with international regulatory standards. A licensed partner not only delivers lower AML risk stablecoins, but also provides advisory support to navigate complex regulatory requirements. This ensures your cross-border payment infrastructure is reliable, transparent, and aligned with global rules.

📍More to Explore:Better Liquidity and Faster Settlement for Payment Service Providers (PSPs): XREX Pay

(2) Benefits of Partnering with a Licensed and Trusted Provider

Once the foundation is in place, enterprises must focus on safeguards and benefits that come with integrating stablecoin payments:

- Credible Issuers and Transparency

Tokens from reputable stablecoin issuers are backed by transparent reserves and governed within regulated frameworks. Verified audits and disclosures reduce the risk of hidden exposures. - Secure Custody of Assets

Safeguard digital assets with regulated custodians, using tools such as multi-signature wallets and offline storage to mitigate cyber threats and operational risks. - Smart Contract and Code Safety

Ensure all smart contracts used in payment rails undergo independent audits to minimize risks from vulnerabilities or exploits. - Compliance-First Infrastructure

Implement AML/KYC processes, Travel Rule compliance, and real-time risk monitoring. This strengthens regulatory alignment and ensures cross-border transfers move smoothly without penalties. - Operational Readiness and Scalability

Prepare internal systems and staff with training, IT integration, and clear scaling roadmaps. Enterprises that plan ahead will more effectively capture the benefits of lower costs and faster liquidity.

In conclusion, while the list of requirements for adopting stablecoin payments may seem extensive, the reality is simpler. By partnering with a licensed and trustworthy provider, enterprises can streamline the entire process—gaining access to stablecoins, expert regulatory guidance, and seamless cross-border payment infrastructure. With the right partner, businesses can bypass unnecessary complexity and focus on enjoying the true advantages of stablecoin payments: speed, efficiency, and reduced risk.

📍More to Explore:Streamlining Cross-Border Payments for Importers and Exporters: XREX Pay

5. Partnering with XREX Pay for Seamless Integration

As stablecoin adoption accelerates globally, choosing the right partner is no longer optional—it is mission-critical. Enterprises need more than just access to tokens; they need a trusted institution that can navigate regulation, safeguard funds, and provide resilient infrastructure.

XREX Pay delivers on this promise with a unique combination of strengths:

- MAS-regulated

XREX Pay operates under an MAS Major Payment Institution (MPI) licence, authorized for six payment services with strict compliance and transparent regulatory oversight.

- Backed by Tether

XREX Pay is under the XREX Group, a blockchain-enabled financial institution backed by the world’s largest stablecoin issuer, Tether. This ensures strong liquidity and credibility across the stablecoin ecosystem.

- Enterprise-grade architecture

Featuring secure custody solutions and a compliance-first payment infrastructure designed to meet global standards.

- BitCheck – the digital escrow for crypto transactions

An escrow service that ensures maximum trust in global trade. Payments are only released once both counterparties fulfill their obligations and approve disbursement. If a deal needs to be canceled, both parties must consent — offering unmatched protection against fraud and disputes.

With this infrastructure, businesses can accelerate their transition to stablecoin-based cross-border payments — gaining faster settlement, lower costs, and peace of mind that every transaction is compliant and secure.

👉 Contact XREX Pay Business Development team today to explore a tailor-made solution that aligns with your business goals and unlocks the full potential of stablecoin payments.

Conclusion

In 2025, stablecoins are redefining cross-border payments—delivering unmatched speed, cost-efficiency, and security. With regulation, growing institutional adoption, robust infrastructure, and real-world results in diverse markets, stablecoins are no longer optional—they’re strategic. Strengthening your payment ecosystem with a partner like XREX Pay positions your business to thrive in the new era of global payment.

About XREX Group

XREX Group is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide services to businesses in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

XREX Singapore operates under the Major Payments Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). XREX Taiwan is a regulated VASP that completed its Compliance Declaration on Anti-Money Laundering (AML) with Taiwan’s Financial Supervisory Commission (FSC) in March 2022. It passed its AML registration with the FSC in September 2025, becoming one of nine approved VASPs.