The stablecoin is a pivotal keyword commanding global financial attention in 2025. It holds not only the immense potential to transform how capital flows worldwide but also a chance to fully realize “financial inclusion” in every corner of the globe.

From the debut of the first stablecoin over a decade ago to the current era of the “stablecoin explosion,” regulatory policies and attitudes especially those championed by the United States have played a critical and crucial catalytic role globally.

The largest stablecoin conference in Asia, the Stablecoin Summit, has been held in Singapore for three consecutive years. Each year, leading industry executives and experts in the stablecoin space gather to discuss the most pressing issues and trends.

What significant value do stablecoins truly bring to human society? What is the next step for the global stablecoin industry in the “Post-GENIUS Act era”?

In his opening keynote speech at the Stablecoin Summit 2025, XREX Co-founder and Group CEO Wayne Huang addressed these questions with a presentation titled “Stablecoins as digital bearer money” .

He covered topics ranging from the inception of currency digitization and the advantages of digital bearer assets to the everyday application of EasyCard, concluding with two key observations on stablecoins. Below is the full English transcript of Wayne’s presentation.

Introduction

All right, good morning. Thank you so much for making it. I can’t believe you guys made it in such an early morning session.

My name is Wayne. Today I’ll be talking about “Stablecoins as Digital Bearer Money”, which I feel is stablecoin’s core innovation and its full potential.

The Dawn of the Internet and the Globalization of Money: The Evolution of Digital Currency

So how did we digitize money? In the 90s, once the internet demonstrated that we can send information in real time and we have the freedom to publish and access information, the money transfer industry started to imagine how we could digitize money.

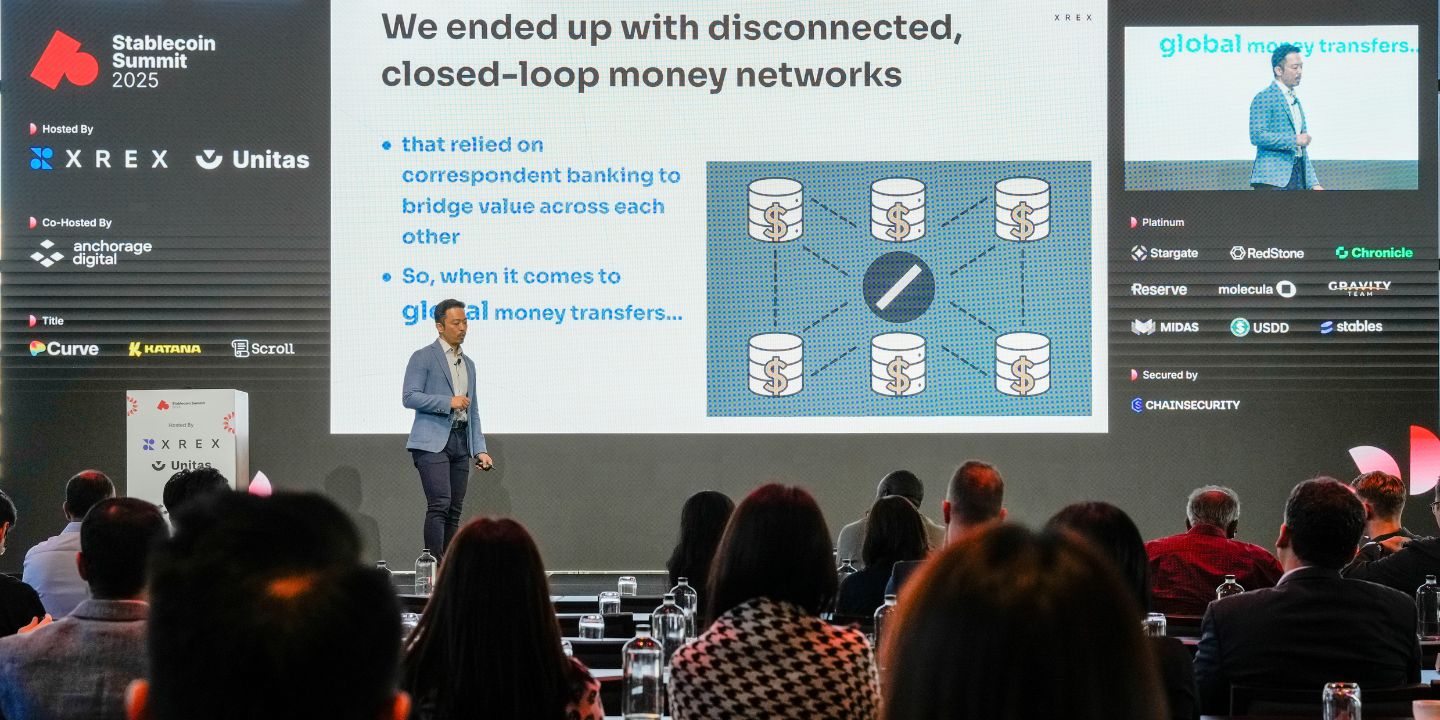

So that we can send money like how the internet sends data. But we didn’t try to digitize paper bills. Instead, we created closed-loop money ledgers.

With remittance and payment products like Venmo, Paytm, WeChat, WeChat Pay, Alipay, and M-Pesa, we started to move money at internet speed.

📍More to Explore:Empowering Gig Economy and Global Labor Mobility with Instant Cross-Border Payouts: XREX Pay

This digital money model breaks when servicing a global user base. Licensing, reporting, and audits per jurisdiction made universal onboarding very difficult, and the post-911 AML requirements made opening an account a compliance challenge.

So we ended up with disconnected, closed-loop money networks that relied on correspondent banking to bridge value across each other. And we had a lot of vostro and nostro accounts.

Why? Because money was permissioned private ledgers, and it was based on a trust model. So when it comes to global money transfers, we never really had a fast global network.

Possession as Ownership? Understanding the Advantages of Digital Bearer Assets

So what if we didn’t digitize money using closed-loop ledgers? What if we tried to digitize paper bills? What’s special about paper bills? Well, the paper bill is a bearer instrument. Possession is finality, and verification is against the bill, okay? Not the holder.

So with a bearer instrument, we don’t care who the holder is. Anybody can hold it. We just care if that bill is genuine and has value. And whoever is in possession of that bill has the right to spend it and is the owner of it.

So paper bills offer better financial sovereignty. Why? Anyone can hold it using any container, right? So if it’s paper cash, if I have hands, I can hold it in my hands, or hold it in my wallet. I can put them in safes regardless of my nationality and jurisdiction, and no one needs an account. That is the financial sovereignty that paper bills can enable.

📍More to Explore:Streamlining Cross-Border Payments for Importers and Exporters: XREX Pay

So we asked what’s the best technology to digitize paper coupons and make it easy for people to access them, authenticate them, and detect counterfeits. What’s the technology? Thank you, Sergio. Of course, it’s the blockchain.

So we created the first fast global money transfer network, and we moved from disconnected closed-loop networks of database ledgers to tokenized cash on permissionless blockchains with tokens that anyone can hold and send, and where no account issuance is required.

The Taiwan Experience: The Connection Between the EasyCard and Stablecoins

When asked about the GENIUS Act, Mr. Dong—he is currently the director of the Taiwanese Central Bank and also the chairman of Megabank, a major bank in Taiwan—said Taiwan had a similar payment product almost 20 years ago, and that attracted some scrutiny.

But I really feel that there’s a lot of truth in what he said because he referred to EasyCard, which was available since 2002, more than 20 years ago, as the digital top-up card for mass transportation payment. And because it needs to be servicing payments for mass transportation, think about buses, MRTs, and trains. The goal was inclusive access.

So it was designed almost like a digital bearer instrument.

Anyone, regardless of nationality, can use it. So it doesn’t matter if you’re from a sanctioned country, as long as you can get yourself to Taiwan and you’ve got paper cash, you can use that paper cash, go to a convenience store, and buy yourself an EasyCard. You can pay anywhere and with any mass transportation system in Taiwan. So, no KYC and no account issuance is required. And you top up with paper cash.

It received the electronic stored value card license in 2010. That’s the ESCVC license in Taiwan. And this license, again, requires no KYC and no account issuance. And expanded to become the most popular payment product in Taiwan. That’s an EasyCard, okay. And I think that’s what Mr. Dong meant when he said, “Oh, stablecoins. Well, we had a similar regulatory regime more than 20 years ago in Taiwan.”

📍More to Explore:Better Liquidity and Faster Settlement for Payment Service Providers (PSPs): XREX Pay

The Prelude to a New Era: When Stablecoins Cease to Be Cashed Out for Fiat

Similarly, stablecoins are a financial inclusion booster because they enable access to the currencies people need or prefer. The world trade currency is the US dollar. Lots of people and businesses need access to the US dollar, and stablecoins gave them that option. And today, people in emerging markets use them for both B2B cross-border payments as well as for person-to-person retail remittances.

Stablecoins are becoming a better alternative to correspondent banking. They have become a more efficient means to move value between two financial institutions, and they significantly reduce pre-funding and in-transit capital. So now we don’t need all these nostro-vostro accounts.

The FIs are starting to use stablecoins. But stablecoins are not only a better settlement technology. Lots of people say, “Oh, it’s only a better settlement technology. Lots of people say, “Oh, it’s a better settlement technology than Swift.” They’re not only that. Because stablecoins are becoming a form of digital bearer money, right?

When you receive an MT-103 telegram from Swift, that is not money itself. You have to go through correspondent banking to move that value. But when you receive stablecoins, stablecoins are by themselves digital bearer money, and so it’s not only a settlement technology.

A stablecoin achieves its ultimate potential when users start to believe it’s money, and not just a settlement instrument. And they stop selling back to fiat. They start to hold it, and start to transact with it.

Liquidity is Trust—But Why?

When you receive a new stablecoin, you’d say, “Well, you know, I’m not comfortable until I settle it back to dollars, until I have dollars in my bank account. Well, today, many stablecoins are seen as money themselves. So we receive a stablecoin, we say, great, it’s settled, I’m going to hold it, I’m going to pay someone else with it. This belief needn’t be in the issuer, but rather in the stablecoins secondary market liquidity.

This is when a stablecoin truly takes on a life of its own. So we say, “Liquidity is trust,” and it’s when stablecoins become money. So although we digitized money a long time ago, with stablecoins, we used permissionless blockchains to create digital bear money, and in my opinion that is the core stablecoin innovation.

Two Observations and the Future Outlook for Stablecoins

Moving forward, I’d like to share two observation points from me following the GENIUS Act.

One, a lot of people, including financial institutions, banks, and regulators, come and ask us about issuing new stablecoins, especially local currency-pegged stablecoins (non-US dollar-pegged stablecoins).

My opinion is there are only two stablecoin markets. Really, you have the US dollar stablecoin as one huge market, and then the rest of the stablecoins. Okay, so when thinking about the stablecoin business, really we’re looking at two very different markets: the US dollar stablecoin and the rest. Because the US dollar remains the dominant medium of exchange and unit of account. That’s number one.

And two, the issuer revenue can’t be forever based on floats, right? So we’ve had long stretches of history where the short-term interest rates were close to zero. Now it’s very high, yes, and issuers are getting great revenue, but throughout history, it wasn’t like this. Also, in 2024, 91% of PayPal’s revenue came from fees, not float.

So what does this mean? Well, okay, so who’s making the fees today? If the issuers are making their revenue from floats, it’s the blockchains, right? Messari reports that over the past few quarters, wallet-to-wallet transfers and stablecoins account for more than 95-98% of transactions on Tron, for example. And Paolo also shared recently that amongst the nine blockchains, Ethereum, Tron, Ton, Solana, 40% of fees are paid to send USDT.

So today, the business model is such that issuers are making their revenue from float while most of the fees go to the blockchains. But if short-term rates won’t stay elevated and payments typically monetize via fees and not float, think about PayPal last year, would stablecoin issuers start to grow their affiliated blockchains to build a more robust revenue model in preparation for the possibility that the revenue from floats may eventually decrease?

So these are my two observations. There you have it! Stablecoins as digital bearer money that stablecoin core innovation and their full potential. Thank you very much.

🚀 If you are ready to explore stablecoin-based payouts, please contact our Business Development team for support. With MAS licensing in Singapore and investment from leading players like Tether, XREX Pay provides secure, compliant, and enterprise-grade payment infrastructure for businesses. Enable faster, cheaper, and safer gig economy payments—and unlock new opportunities for growth.

About XREX Group

XREX Group is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide services to businesses in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

XREX Singapore operates under the Major Payments Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). XREX Taiwan is a regulated VASP that completed its Compliance Declaration on Anti-Money Laundering (AML) with Taiwan’s Financial Supervisory Commission (FSC) in March 2022. It passed its AML registration with the FSC in September 2025, becoming one of nine approved VASPs.