Key Takeaways

- XREX introduces the All-in-One Grid Bot featuring three major strategies: Long, Short, and Neutral. These strategies enable investors to execute precise trading operations whether the market is bullish, bearish, or moving sideways.

- The Long strategy is optimal when prices show an upward trend; the Short strategy is suitable when anticipating market downturns; while the Neutral strategy maintains no directional bias, making it ideal for markets oscillating within a specific range.

- Grid trading is a versatile and powerful approach. Through its three distinct strategies—Long, Short, and Neutral—investors can effectively manage risk and maintain steady profits in volatile markets while maintaining discipline, and overcoming the two major challenges of human nature and timing.

By Carlos Kao

Everyone aspires to generate profits and passive income through investments. However, accurately analyzing various factors that influence investment outcomes—such as political and economic conditions, industry trends, and price movements—requires not only years of accumulated experience but also strict adherence to investment principles. Maintaining judgment free from the influences of human nature and timing is an extremely challenging discipline.

Previously, XREX introduced the Grid Bot, a tool that helps investors maintain disciplined, systematic buying and selling patterns, and overcoming the human tendency to chase highs and panic sell. Interested readers can refer to our previous tutorials for more information. While the Grid Bot can assist with market monitoring, investors still need to initially assess potential market trends to determine whether to take long or short positions.

XREX has launched the All-in-One Grid Bot, featuring three major strategies: Long, Short, and Neutral. Whether markets are rising, falling, or moving sideways with unclear direction, this tool helps investors precisely capture profitable trading opportunities and generate more passive income.

This article will explore the applicable scenarios for these three trading strategies and their associated risks, helping you move closer to your investment goals.

What is a Grid Trading Bot and What Are Its Benefits?

A Grid Trading Bot is a common investment tool in the cryptocurrency market that automatically executes trades according to user-defined parameters. XREX Product Manager Sean Hsu highlights two major advantages of grid trading:

Benefit 1: Embracing Market Volatility

The cryptocurrency market is characterized by high volatility and 24-hour trading, making it easy to miss crucial market movements. Investors only need to set their desired price range, investment amount, and number of grids. The bot automatically purchases when prices reach any predetermined buy level, and sells when market prices hit set sell levels. As long as prices remain within the configured range, the bot consistently executes the investor’s trading strategy without emotional or timing biases.

Benefit 2: Emotion-Free Decision Making

During periods of extreme market volatility, investors often make impulsive decisions influenced by emotions that deviate from their original objectives, falling prey to human nature and human error. Grid trading automatically executes all trades based on preset conditions, eliminating the risk of making wrong decisions due to anxiety, stress, or the common crypto phenomenon of FOMO (Fear of Missing Out). Once configured, the Grid Bot maintains trading discipline.

Caption:A Grid Trading Bot is a common investment tool in the cryptocurrency market that automatically executes trades according to user-defined parameters. Source / Canva

Caption:A Grid Trading Bot is a common investment tool in the cryptocurrency market that automatically executes trades according to user-defined parameters. Source / Canva

Strategy 1: What is Long Trading and When Should it Be Used?

Going Long refers to when traders anticipate price appreciation in cryptocurrency. This strategy is particularly suitable during periods of price volatility with an overall upward trend. The Long Grid strategy involves gradually buying during price dips and selling in increments during price increases, profiting from the buy low, sell high price differentials.

In a Long Grid setup, the bot initially purchases a portion of the cryptocurrency at the current market price when the grid is established, creating an initial position.

- ⬆️ When Prices Rise: The bot sells holdings in increments to lock in profits.

- ⬇️ When Prices Fall: The system automatically implements buy low orders, then sells high

when prices recover, generating profits through repeated trading cycles.

Let’s examine a trading scenario to better understand how the Long Grid strategy operates:

Understanding Long Strategy Through a Real-World Scenario

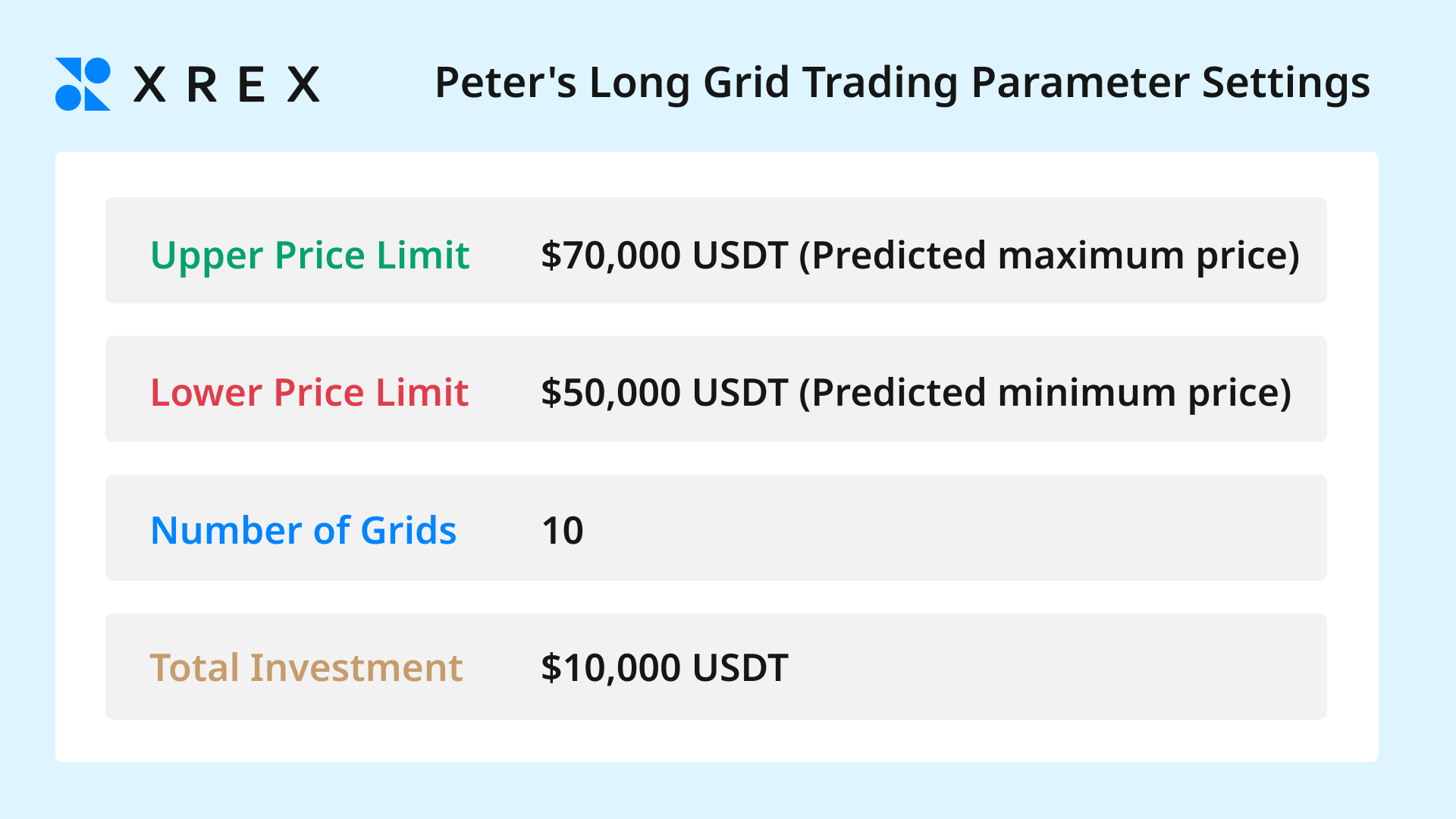

Peter, a cryptocurrency investor with two years of experience, anticipates that Bitcoin will continue trending upward over the next month despite volatility. He decides to implement a Long Grid strategy.

Setting Up Long Grid Parameters

Here are the parameters Peter set for his Long Grid:

Five Key Steps to Understanding Long Grid Trading Execution

Assuming Bitcoin’s price is $60,000 USDT when the grid is established, based on Peter’s settings, the Grid Bot will automatically execute these five steps:

Step 1: Fund Allocation

The Grid Bot divides the total investment ($10,000 USDT) into 10 equal portions, with each portion being $1,000 USDT (total investment ÷ number of grids).

Step 2: Grid Interval Calculation

The difference between upper and lower limits is $20,000 USDT. When divided into 10 grids, each grid has a price interval of $2,000 USDT, meaning a grid trade is triggered every time Bitcoin’s price moves by $2,000 USDT.

Step 3: Establishing Initial Position

Since the upper limit of $70,000 USDT is higher than the current price of $60,000 USDT, the Grid Bot purchases Bitcoin at the current price of $60,000 USDT to establish an initial position. The position is established by creating five grids downward from the upper limit of $70,000 USDT, with $2,000 USDT intervals between each grid. Each grid invests $1,000 USDT, totaling $5,000 USDT worth of Bitcoin.

Step 4: Setting Initial Grid Orders

- 📌 Sell Orders: For the initial five grid positions, Bitcoin worth $5,000 USDT is purchased at the current price of $60,000 USDT. However, the bot places sell orders at price points of $62,000, $64,000, $66,000, $68,000, and $70,000 USDT, following the $2,000 USDT price intervals.

- 📌 Buy Orders: Simultaneously, the bot places five grid buy orders from the current price of $60,000 USDT down to the lower limit of $50,000 USDT, at price points of $58,000, $56,000, $54,000, $52,000, and $50,000 USDT, maintaining the $2,000 USDT intervals.

Step 5: Initiating Automated Trading

- 📌 Buying: When Bitcoin drops by $2,000 USDT, the corresponding buy order in the order book is executed. After execution, the bot automatically places the next grid sell order at a $2,000 USDT price interval above.

- 📌 Selling: When Bitcoin rises by $2,000 USDT, the corresponding sell order in the order book is executed. After execution, the bot automatically places the next grid buy order at a $2,000 USDT price interval below.

Through this mechanism, Peter can continuously profit from price volatility without constantly monitoring the market and cryptocurrency prices.

Strategy 2: What is Short Trading and When Should it Be Used?

Going Short refers to when traders anticipate a decrease in cryptocurrency prices. This strategy is particularly suitable during periods of price volatility with an overall downward trend. The Short Grid strategy involves borrowing and selling cryptocurrency from the trading platform in increments when prices rise, then buying back at lower prices to repay the loans, profiting from the sell high, buy low price differentials.

The Short Grid follows similar logic to the Long Grid but in the opposite direction. When implementing a Short Grid, the bot initially borrows and sells cryptocurrency at the current market price to establish an initial position.

- ⬆️When Prices Rise: The Grid Bot incrementally borrows and sells (sells high) based on current prices.

- ⬇️When Prices Fall: The system automatically buys back in increments (buys low) to cover positions that were sold at higher prices, continuously generating profits through the sell high, buy low cycle.

Let’s examine a trading scenario to better understand how the Short Grid strategy operates.

Understanding Short Strategy Through a Real-World Scenario

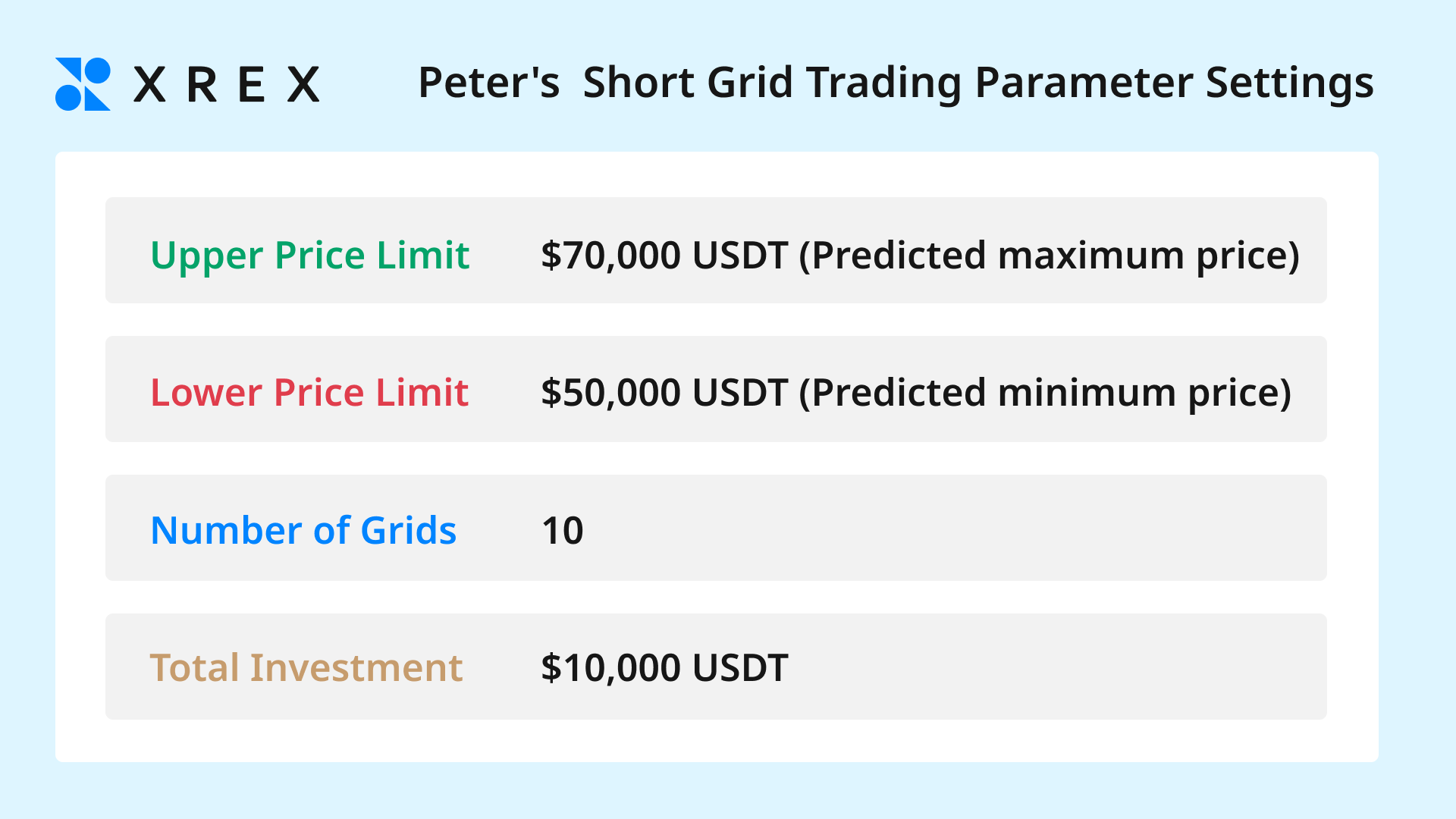

Peter, a cryptocurrency investor with two years of experience, anticipates that Bitcoin will gradually decline over the next month despite volatility. He decides to implement a Short Grid strategy.

Setting Up Short Grid Parameters

Here are the parameters Peter set for his Short Grid:

Five Key Steps to Understanding Short Grid Trading Execution

Assuming Bitcoin’s price is $60,000 USDT when the grid is established, based on Peter’s settings, the Grid Bot will automatically execute these five steps:

Step 1: Fund Allocation

The total investment is divided into 10 equal portions of $1,000 USDT each.

Step 2: Grid Interval Calculation

The difference between upper and lower limits is $20,000 USDT. When divided into 10 grids, each grid has a price interval of $2,000 USDT, meaning a grid trade is triggered every time Bitcoin’s price moves by $2,000 USDT.

Step 3: Establishing Initial Position

Based on the downward price prediction, the Grid Bot borrows and sells Bitcoin at the current price of $60,000 USDT to establish an initial position. The position is established by creating five grids downward from the current price of $60,000 USDT, with $2,000 USDT intervals between each grid. Each grid sells $1,000 USDT worth of Bitcoin, totaling $5,000 USDT worth of borrowed and sold Bitcoin.

Step 4: Setting Initial Grid Orders

- 📌 Buy Orders: For the initial five grid positions, the bot borrows and sells Bitcoin worth $5,000 USDT at the current price of $60,000 USDT. The bot then places buy orders at price points of $58,000, $56,000, $54,000, $52,000, and $50,000 USDT, following the $2,000 USDT price intervals.

- 📌 Sell Orders: Simultaneously, the bot places five grid sell orders from the current price of $60,000 USDT to the upper limit of $70,000 USDT, at price points of $62,000, $64,000, $66,000, $68,000, and $70,000 USDT, maintaining the $2,000 USDT intervals.

Step 5: Initiating Automated Trading

- 📌 Buying: When Bitcoin drops by $2,000 USDT, the corresponding buy order in the order book is executed. After execution, the bot automatically places the next grid sell order at a $2,000 USDT price interval above.

- 📌 Selling: When Bitcoin rises by $2,000 USDT, the corresponding sell order in the order book is executed. After execution, the bot automatically places the next grid buy order at a $2,000 USDT price interval below.

Through this mechanism, Peter can profit from price volatility without constantly monitoring the market and cryptocurrency prices.

Strategy 3: What is Neutral Trading and When Should it Be Used?

The Neutral strategy is ideal for markets with unclear or unpredictable directions. During periods without distinct trends, the Neutral strategy operates without directional bias, generating profits regardless of market movement. This approach allows traders to avoid predicting whether the market is bullish or bearish, instead flexibly taking both long and short positions during price fluctuations.

The operational logic of neutral grid trading differs slightly from Long or Short strategies. When initiating a neutral grid, the bot doesn’t establish an immediate position (no direct buying or selling). Instead, it uses the initial price as a reference point, placing short orders during price increases and long orders during price decreases, profiting from price differentials during volatility.

Compared to Long and Short strategies, the Neutral strategy’s advantage lies in requiring neither an initial position (trading in the expected direction) nor market direction prediction, making it suitable for markets experiencing price fluctuations without a clear directional trend.

- ⬆️ When Prices Rise: The Grid Bot places short orders above the initial reference price.

- ⬇️ When Prices Fall: The Grid Bot places long orders below the initial reference price.

Let’s examine a trading scenario to better understand how the Neutral Grid strategy operates.

Understanding the Neutral Strategy Through a Real-World Scenario

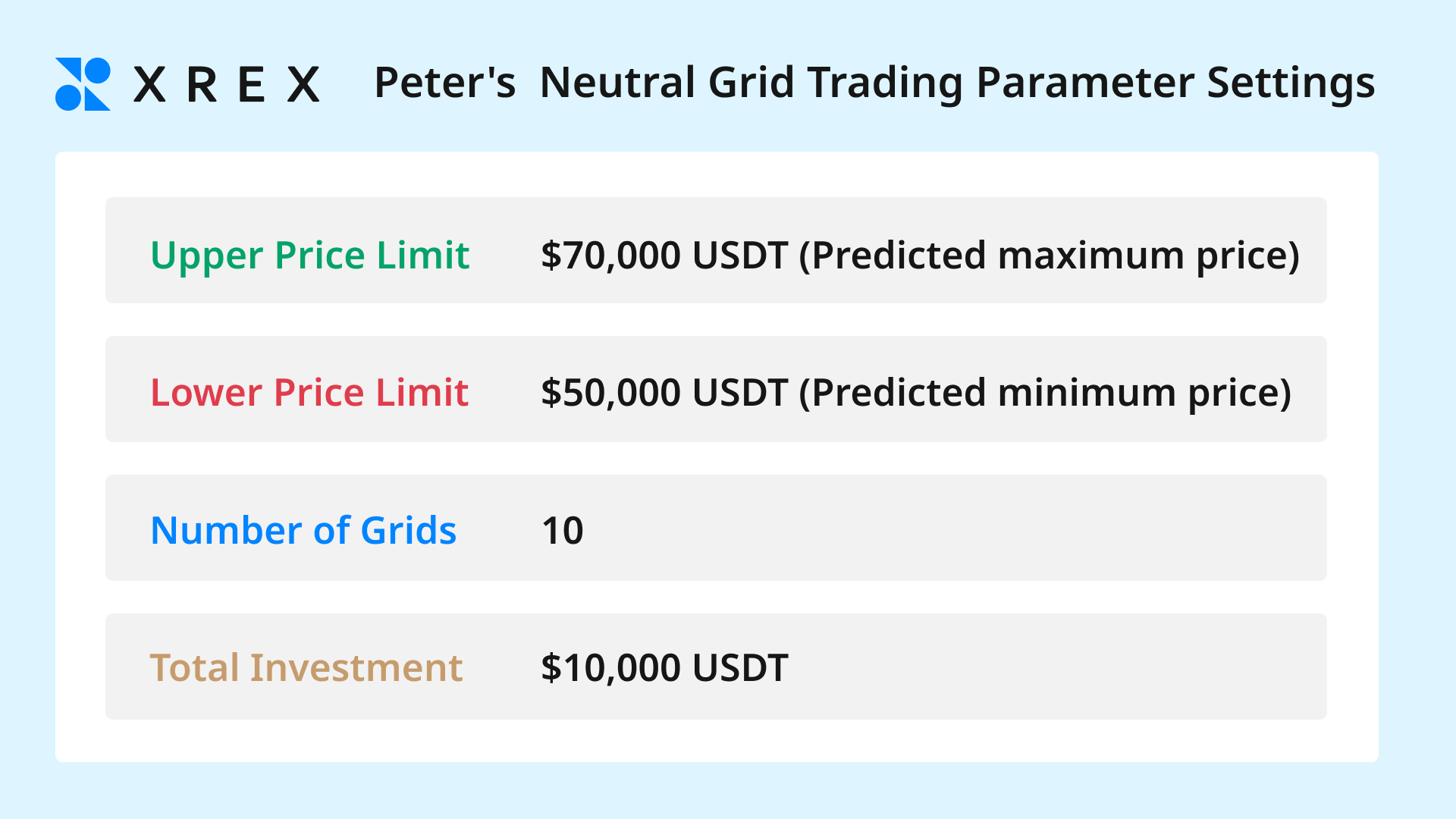

Peter, a cryptocurrency investor with two years of experience, observes that Bitcoin has been fluctuating between $50,000 and $70,000 USDT recently. He anticipates that the price will continue to move sideways within this range over the next month. Based on this assessment, he decides to implement a Neutral Grid strategy.

Setting Up Neutral Grid Parameters

Here are the parameters Peter set for his Neutral Grid:

Five Key Steps to Understanding Neutral Grid Trading Execution

Assuming Bitcoin’s current price is $60,000 USDT, based on Peter’s settings, the Grid Bot will automatically execute these five steps:

Step 1: Fund Allocation

The total investment is divided into 10 equal portions, with each portion being $1,000 USDT (total investment ÷ number of grids).

Step 2: Grid Interval Calculation

The difference between upper and lower limits is $20,000 USDT. When divided into 10 grids, each grid has a price interval of $2,000 USDT, meaning a grid trade is triggered every time Bitcoin’s price moves by $2,000 USDT.

Step 3: Setting Initial Orders

- 📌 Sell Orders: Using the current price of $60,000 USDT as a reference point, the Grid Bot places five grid sell orders upward to the upper limit of $70,000 USDT, at price points of $62,000, $64,000, $66,000, $68,000, and $70,000 USDT, following the $2,000 USDT intervals.

- 📌 Buy Orders: Simultaneously, the bot places five grid buy orders from the current price of $60,000 USDT down to the lower limit of $50,000 USDT, at price points of $58,000, $56,000, $54,000, $52,000, and $50,000 USDT, maintaining the $2,000 USDT intervals.

Step 4: Initiating Automated Trading

- 📌 Buying: When Bitcoin’s price drops by $2,000 USDT, the corresponding buy order in the order book is executed. After execution, the bot automatically places the next grid sell order at a $2,000 USDT price interval above.

- 📌 Selling: When Bitcoin’s price rises by $2,000 USDT, the corresponding sell order in the order book is executed. After execution, the bot automatically places the next grid buy order at a $2,000 USDT price interval below.

Through this mechanism, Peter can continuously profit from price volatility without constantly monitoring the market and cryptocurrency prices.

What Are the Risks of Grid Trading?

Grid trading is an automated trading strategy that executes multiple trades automatically, continuously, and systematically based on user-defined rules. In theory, grid trading can reduce emotional interference and minimize risk through fund diversification and avoiding lump-sum investments.

However, grid trading is not risk-free. The main risks stem from inherent market risks associated with Long, Short, and Neutral strategies. Here are specific risks for each trading strategy:

What Are the Risks of Long Trading?

The Long Grid strategy is suitable for upward price trends where the bot executes a buy low sell high strategy within a price range, accumulating overall profits from price fluctuations. Theoretically, larger price movements within the set range create more profit opportunities. However, the risks of Long strategy include:

- 📌 High Average Entry Price: Grid-based incremental buying means each Bitcoin purchase has a different cost basis. In markets with low volatility and continuous downward trends, the average holding price may exceed the current market price, preventing profitable exits.

- 📌 Price Breaking Below Lower Limit: Once the price falls below the lower boundary, all funds have been used to purchase Bitcoin, and the bot stops trading until prices return to the set range. If prices continue to fall, unrealized losses on Bitcoin holdings will increase. Therefore, selecting appropriate price ranges and grid numbers in long strategies is crucial for effective risk management.

What Are the Risks of Short Trading?

The Short Grid strategy involves borrowing and selling cryptocurrency in increments during price increases, planning to buy back at lower prices to realize profits. Since short selling involves borrowing and selling first then buying back later, the main risks appear when prices move against the position:

- 📌 Collateral Liquidation Risk: In short strategies, the sold Bitcoin is borrowed. If the market moves upward, accumulated losses increase. Once losses exceed the collateral value ratio, forced liquidation may occur, resulting in total investment loss. Unlike long positions where the main risk is price depreciation of held assets, short positions involve collateral risks from borrowed assets. Therefore, short grid strategies require strict control of upper price limits and collateral ratios to manage sudden market upswings.

What Are the Risks of Neutral Trading?

The Neutral strategy theoretically carries lower risk compared to directional long or short strategies, as it doesn’t rely on single-direction market movements. However, it still faces risks, particularly when prices show clear upward or downward trends beyond set boundaries:

- 📌 Lower Boundary Breach Risk: Similar to long strategy risks when prices continuously fall below the lower boundary. The system holds large amounts of incrementally purchased assets, risking unrealized losses if prices don’t recover.

- 📌 Upper Boundary Breach Risk: Similar to short strategy risks when prices continuously rise above the upper boundary. The system holds large short positions from incremental selling, risking losses if prices don’t return, and possible liquidation if prices continue rising beyond collateral ratios. Therefore, the Neutral strategy is best suited for sideways markets. When markets show clear directional trends, price movements beyond boundaries carry risks similar to long or short strategies.

Caption:However, grid trading is not risk-free. The main risks stem from inherent market risks associated with Long, Short, and Neutral strategies.

Caption:However, grid trading is not risk-free. The main risks stem from inherent market risks associated with Long, Short, and Neutral strategies.

Profit from All Market Conditions with Three Grid Strategies

High volatility characterizes the cryptocurrency market. While this can enable rapid achievement of investment goals when managed properly, it can also lead to quick losses without adherence to investment principles.

Grid trading is a flexible and powerful strategy that helps investors maintain steady profits in volatile markets while maintaining discipline, overcoming the two major challenges of human nature and timing.

In today’s rapidly changing global political and economic landscape, investment markets transform quickly. Through grid trading’s three major strategies—Long, Short, and Neutral—both novice and experienced traders can efficiently execute investment strategies and realize profits across rising, falling, or sideways markets.

All information services provided by our company are based on current conditions and may change with subsequent developments. All information is for reference only and does not constitute professional investment advice. If you intend to make any investment or take specific actions based on this information, we recommend conducting your own careful risk assessment and making independent judgments.

About XREX Group

XREX Group is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide services to businesses in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

XREX Singapore operates under the Major Payments Institution (MPI) license issued by the Monetary Authority of Singapore (MAS). XREX Taiwan completed its Compliance Statements on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) with Taiwan’s Financial Supervisory Commission (FSC) in March 2022, and is a regulated VASP.

![[Comprehensive Guide] Execute Trades in any Market Condition: Your Complete Guide to Long, Short, and Neutral Trading Strategies](https://xrex.io/tw/en/blog/wp-content/uploads/2024/11/5.png)

![[Important Update] XREX Exchange to Discontinue A2ZCrypto SWAP Plugin Services](https://xrex.io/tw/en/blog/wp-content/uploads/2025/07/XREX_GD_Important-Update.jpg)