Cryptocurrencies are volatile; there is no limit to price soar and plunge, and the market runs 24/7/365.

In November 2021, we witnessed Bitcoin hitting its highest — over $68,000 — it fell to almost 50% of that in January 2022 which led the entire market into a bearish mode.

Such volatile characteristics in cryptocurrencies are unappealing to everyday investments and utility. As a result, stablecoins were introduced, most of which are pegged to real-world currency through different mechanisms to address volatility issues. Stablecoins can be moved across blockchains as easily as any other cryptocurrency without being eaten by cruel volatility.

In 2014, Tether Limited was the first company to introduce USDT into the crypto space and remained the most dominant. Being a US Dollar-backed stablecoin, they were introduced into almost 90% of major exchanges by 2017.

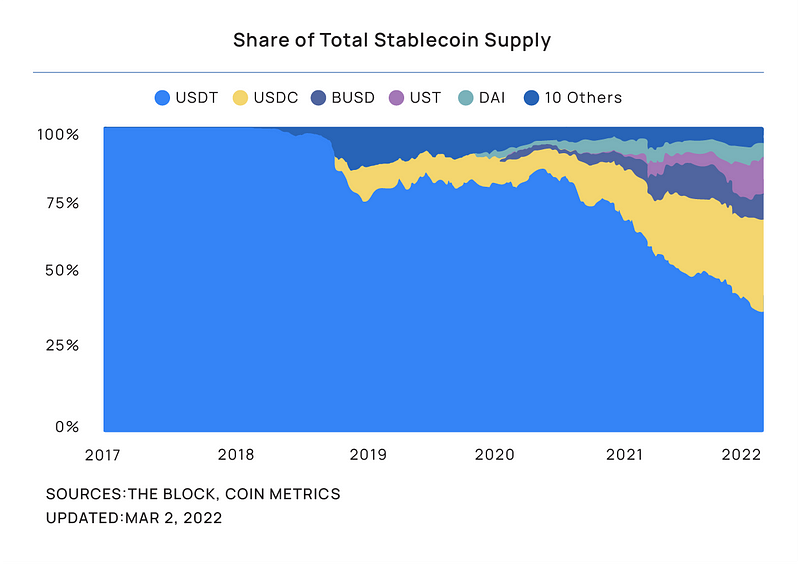

Since February 2020, USDT dominance has fallen from around 88% to nearly 44%, due to the increase in adoption of different stablecoins such as USDC, BUSD, DAI, and UST, as shown in the graph below. Yet USDT has the highest market cap of $78 billion; USDC issued by Circle stands second in the market cap with $52 billion.

Currently, the global market cap of all cryptocurrencies is over $2 trillion. Stablecoins captured around 9% of it; USDT counted for 44% of the entire stablecoins market.

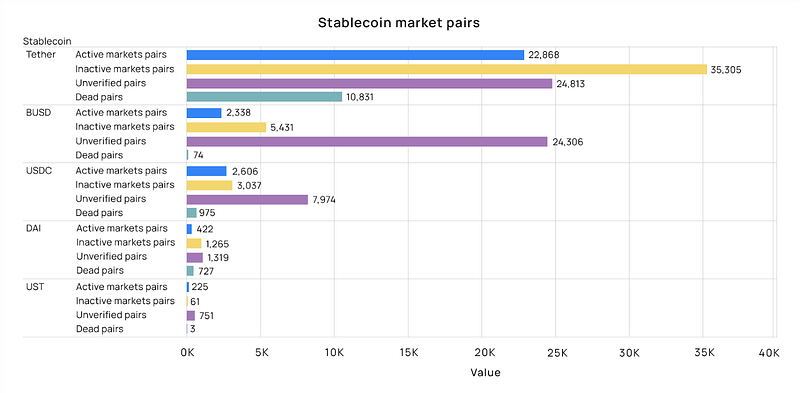

From the following graph of stablecoin market pairs, you can observe 47,681 active and unverified market pairs with USDT, whereas BUSD has the second highest of only 26,644 active and unverified market pairs.

Such utter dominance of USDT has raised concerns among regulators who questioned if Tether holds enough reserves to peg USD that is in supply. With pressure from regulators, Tether continues to induce the stablecoin into the ecosystem through new applications.

In this article, we take a deep dive into the up-to-date information about opportunities and risks that are underlying with Tether, specific to DeFi users who participate in different projects with USDT.

Tether (USDT)

Tether is a centralized stablecoin that is backed by USD. To recap, this means that for every 1 USDT in circulation, it is pegged to 1 USD in the market. As mentioned earlier, Tether is the first to introduce its stablecoin to the crypto world and has been at the top in market capitalization. Tether is currently operable on nine different blockchains and available on the majority of top centralized and decentralized exchanges.

Of all the USDT authorized for usage across different blockchains, 49% is on the Ethereum network (ERC-20), and 46.8% is on the Tron blockchain (TRC-20). The rest of USDT has been authorized on other blockchains, mainly on Solana, Omni, and Alogrand, among others, as shown in the graph below.

Opportunities

Stablecoins such as USDT are already an important element in the crypto ecosystem. USDT transactions can be settled quickly at as low as 1 USDT, and allow accountability and transparency with on-chain recorded data. Many have used USDT for cross-border business payments and international transfers. USDT is vastly adopted over multiple chains and creates tremendous opportunities for DeFi users such as: staking USDT to earn recurring rewards, using it as a mode of payment, and using it as trading pair for thousands of cryptocurrencies over a hundred exchanges.

-Staking

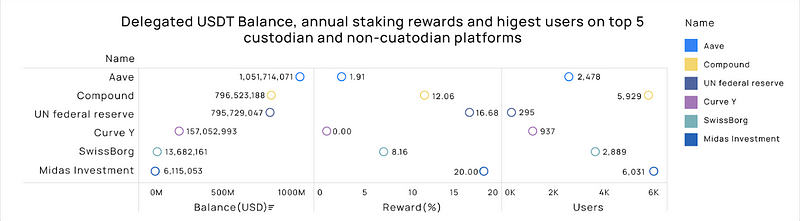

USDT is not famously used for storing value but due to its wide adoption, there are many staking opportunities across plenty of platforms; the top five are shown in the following infographic image.

On Aave alone, $1 billion USD equivalent USDT is staked and delegated by 2,478 users through which the users can earn an APY of 1.91%. If you find Aave interest rates too low, there are other platforms such as Midas investment and Compound finance which offer 20% and 12.06% APY correspondingly, which is also a reason why both of these platforms have a lot of user base.

There are other platforms where you can delegate for higher staking rewards but you must be fully aware that these platforms are custodians, which means the platform holds your private keys and you trust them. To select a trustworthy platform to secure your crypto assets, security is the most important consideration. Crypto-fiat exchange such as XREX is a good option as it’s run by a world-class cybersecurity team. Staking through XREX is easy, simple, and safe as you don’t need to handle private keys and you can stake with just a click to earn recurring rewards.

-Bridges

Since Ethereum has almost 49% of USDT supply and is reputed for high transaction fees, a lot of bridges were introduced in the last couple of years to enable Ethereum users to migrate to different chains.

To transfer USDT on Ethereum, it costs $25 to $50 USD on average, which is unsustainable for a lot of retail investors. Whereas, on Tron (TRC20), BNB Beacon chain (BEP2), BNB smart chain (BEP 20), and Solana blockchain, sending any amount of USDT, one USDT is collected as the transaction fee and settles the transaction in less than five minutes.

Polygon (previously Matic) has been a big influence on the Ethereum ecosystem due to its interoperability where ERC-20 tokens can be moved across the blockchain for 10 times lower prices than on Ethereum.

To move USDT on Polygon, it costs $1 to $3 USD equivalent Matic tokens. Similarly, Avalanche Bridge directly connects with your MetaMask wallet to transfer from Ethereum to Avalanche. This is also a cheap and secure way.

-Modes of payments

Plenty of merchants and businesses, including reputed firms such as Travala.com, STAX, TIME magazine, and Vertis Aviation, accept Tether as a mode of payment. Additionally, a few payment gateways including NOWPayments, DizPay, and CoinsPaid, actively promote Tether as a payment mode to their merchants.

Blockchain fintech company XREX offers BitCheck for cross-border merchants to make payments with an online guarantee. Currently, BitCheck’s fee is zero. After receiving USDT via BitCheck, XREX users can directly convert USDT to USD and withdraw to their bank accounts all over the world.

Using these payment gateways, invoicing, transaction status and details are conveniently available at a very low fee. Recently, Myanmar’s shadow National Unity Government (NUG) has also adopted USDT as a legal tender to gain control over trades and overcome the economic hurdles imposed by the military coup that has overthrown the Myanmar elected government.

Risks

USDT has grown to be ambiguous; concerns were raised regarding their high market share of stablecoins which was followed by lawsuits. Concerns were mainly about the team’s centralized authority over the entire USDT supply, lack of regulatory audits to prove issued claims, and the instability to maintain the peg.

-Centralized authority

Although USDT transactions are highly transparent on blockchains, the central authority over assets on any chain raises concerns to many users. Due to various reasons, Tether has a record of blacklisting addresses and freezing USDT to prevent withdrawals by users. This is mainly because blacklisted addresses are subjected to frauds, hacks, and/or illegal operations.

By freezing assets, Tether recovered stolen assets on multiple occasions. However, a company with 80% of the global stablecoin market cap having such power to freeze assets and reverse transactions can impact the entire crypto market if things go sideways.

-Regulatory & auditing

Worry about other stablecoin projects was raised by Tether authorities which carries a risk to financial stability due to the lack of third-party audits and lack of transparency for claims that backed to 1:1 peg of USDT to the USD.

Because of such controversial accusations, Tether officials redesigned their website and enabled a transparency tab where they showcase their audited reports by Moore Cayman, an auditing services firm that declared Tether’s assets exceed liabilities.

The breakdown of their reserves is as shown in the following image. Having 44% of assets in the form of commercial paper and 28% in treasury bills, and 10.46% in cash and bank deposits, USDT is pegged to maintain its stability.

In spite of such attempts, concerns regarding Tether’s assets still remain because proof of treasure reserves are nowhere to be found. A few groups believe that rigorous auditing will be necessary to get proof. A short-seller research firm Hindenberg has announced a $1 million USD bounty for whoever discloses any assets backed by Tether.

Recently, the new Federal Reserve stablecoins report has stated a ‘Two-tiered Intermediation” approach to regulating stablecoins, which if implemented, will enforce firms to conduct thorough auditing and public release of assets that back stablecoins. This will protect the traditional financial system from disruption and also bring further transparency to reserves.

-Risks of depegging

Depegging custodial stablecoins such as USDT can happen due to various incidents, including not having enough reserves for the issued liabilities and price manipulation in the market.

The top 10 market pairs which have the highest impact on USDT pegging are shown in the below infographic. Binance CEX has the highest impact on the USDT pegging price with almost six pairs, namely BTC, FTM, ETH, BUSD, BNB, and LUNA.

In any case, even if the top 10 pairs have a fluctuation in daily trading volume and the corresponding exchange’s reputation is at stake, pegging can be fluctuated but stabilizes quickly if investors still use other USDT market pairs.

In March 2015, USDT witnessed an all-time low of $0.57 USD due to the change in demand but quickly recovered to its pegged price. In July 2018, it witnessed an all-time high of $1.32 USD due to the increase in demand for USDT over different market pairs across corresponding exchanges, which created arbitraging opportunities for many traders. Besides such events, USDT has been stable with only a swing of 1 or 2 cents more or less than the $1.

Conclusion

USDT has a few regulatory concerns but besides that, it is a legit firm and vastly used specifically as the trading pair across more than a thousand platforms. Moreover, USDT has become an important innovation in the crypto space which led to the accommodation of DeFi projects, including liquidity pool staking.

USDT is now accepted by well-known and globally accepted merchants to purchase airline tickets, hotel accommodations, and IPOs. USDT is also in the process of adoption by several payment gateways and being introduced to their merchants. Overall, USDT enables entrancing development to the crypto world and may boost its market dominance with more transparency issued by firms.

“Tether is the ultimate digital eurodollar, and a lot of people trust USDT not because they have done business with Tether at scale (though many have), or because they believe the USDT reserves are fully backed (at times, they haven’t been), or because they are comfortable being complicit in a global conspiracy (nobody’s got time for that), but rather because at the end of the day they have to trust Tether, and the system has worked so far”

— Ryan Selkis, founder @messaricrypto.

The increase in other stablecoins dominance over USDT in the past few months showcases the demand and necessity for more transparent, much faster, utility-specific stablecoins. Recognizing this, the US President’s working group for Federal Deposit Insurance Corporation had several hearings recently and prepared a report on Stablecoins to bring different strategies to regulate stablecoins without disrupting traditional finance.

“Digital assets have the potential to be as revolutionary as the Internet. It’s important [that] lawmakers and regulators alike work to continue America’s long standing tradition of fostering technological innovation — not stifling it.” said Pennsylvania Senator Pat Toomey.

In conclusion, the future of the crypto economy is pretty much up to its investors and adopters. If more stablecoins like USDT and USDC are regulated, they’ll get a lot more stable and a balance will be found between traditional finance and crypto innovation. A better and more inclusive financial system for the future economy can benefit everyone worldwide. Stablecoins will play a crucial part.