2021 Virtual Assets-Related Financial News

Crypto marched into the physical world in February 2021 when Tesla filed with the SEC regarding its purchase of bitcoin worth $1.5 billion USD and accepted Bitcoin as a method of payment in March (then stopped the Bitcoin payment in May).

As a new member of S&P 500 in December 2020, Tesla connected the traditional financial index to the crypto world, followed by Coinbase’s IPO in April 2021 and ProShares’ first Bitcoin exchange-traded fund (ticker BITO) in October 2021.

What is more visible is that Crypto.com spent $700 million buying the naming rights to Lakers Staples Center, now renamed Crypto.com Arena. These days, everyone can expect to see more crypto in their daily lives.

What will it mean to regulators and Wall Street/Main Street investors when crypto assets meet the physical economy in the form of commodity, currency, or financial products in 2022?

This article highlights the legal implication of virtual assets from government and industry perspectives. As explained below, because a government has multiple policy goals, different regulators (even within one country) will treat crypto assets and users differently.

From the industry perspective, the accounting rule on crypto assets significantly influences corporations’ decisions on crypto investment in general. It is worth noting the development of relevant accounting rules. Similarly, as financial institutions become more interested in crypto assets, risk management and banks’ participation in the crypto industry sheds light on how they view crypto assets.

Government Perspectives: Financial Stability, Investor Protection, and Business Promotion

If we want to figure out what crypto assets are in the eyes of regulators, we have to understand their goals. We may tend to think that a government is a uniform and harmonized actor, but it is not.

A government has many policy goals attempted by various regulators, let alone dealing with financial and economic differences between countries and jurisdictions. Because financial stability, investor protection, and business development are the three main goals most governments strive to achieve, we can obtain a preview of crypto regulation in 2022 from these policy goals:

I. Financial stability — Crypto assets are not currency — at least not yet (except El Salvador)

Except for El Salvador which designated Bitcoin as its legal tender, no central government regards crypto assets as legal tender. A few governments such as India and China consider most private cryptocurrencies a threat to the financial system. For example, a joint statement from main Chinese authorities, including People’s Bank of China, Supreme People’s Procuratorate, and Supreme People’s Court, alleges that all crypto activities are “illegal and against public policy.” Similarly, the Indian government has resisted cryptocurrencies. Although the Supreme Court of India struck down the crypto ban issued by the Reserve Bank of India (RBI), RBI has advocated a complete ban on crypto because it has “serious concerns,” and a “partial ban won’t work.”

Most governments view crypto assets as a mix of opportunity as well as a threat. For example, the position paper published by the South African Reserve Bank and other agencies stated that South Africa remains neither hostile nor friendly to crypto assets because crypto assets are not “money,” but merchants and consumers can still accept crypto assets as a method of payment. On the other hand, South Africa officials have become aware of the high volume of crypto trading in South Africa and the potential challenge to its foreign exchange regulation. Thus, to serve its Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) policies and control cross-border financial flows, South Africa officials plan to regulate entities that provide crypto services.

Despite many regulators’ disbelief in crypto assets, several government officials who disfavor crypto assets still believe that blockchain technology can benefit our financial systems by using central bank digital currencies (CBDCs). Two major CBDC projects that attract the world’s eyeballs and are significant for future development are Project Dunbar and China’s CBDC multi-city program.

The Dunbar project is conducted by central banks of South Africa, Singapore, Australia, and Malaysia to see whether the CDBC can help cross-border payments and international settlement. Although there are potential financial inclusion benefits, “[the] issuance of a retail CBDC is ultimately a socio-economic rather than a monetary consideration,” said Ravi Menon, managing director of the Monetary Authority of Singapore. He pointed out that a digital Singapore dollar is not yet “compelling” because a supermajority of Singaporeans has bank accounts.

Likewise, China’s CBDC pilot program aims to provide financial inclusion for those without a bank account while mitigating Know Your Customer (KYC) risks, regardless of its strong enforcement against cryptocurrencies.

The Chinese CBDC multi-city program is one of the most advanced CBDC market applications given its early start in 2019. Meanwhile, the People’s Bank of China (PBoC) also uses this pilot program to test its cross-border payments between the Chinese mainland and Hong Kong via eCNY and eHKD exchange.

Mu Changchun, Director General of China’s central bank Digital Currency Research Institute, believes that after the COVID-19 pandemic, the CBDC will “facilitate the cross-border transactions between Hong Kong and the Mainland” when tourists from the Mainland visit Hong Kong.

It seems that some central banks strongly oppose crypto assets not because the blockchain technology itself is not good for financial stability, but because “crypto assets may one day reduce demand for central bank money” and thus weaken the monetary policies of central banks, according to the IMF’s warning.

Therefore, crypto assets have somehow created competitive pressure on central banks. Instead of banning crypto assets, the challenged central banks should provide faster and more efficient fiat payment solutions, while other regulators should hold crypto asset service providers accountable to protect investors and customers (as we will discuss below).

II. Investor protection — Crypto assets bring another challenge to investor protection regulators

Currently, most regulators have been regulating crypto-related investment as if they are traditional financial products. Both the US and Australian legal regimes are based on the presumption that the disclosure system protects investors from manipulation or fraud, and that the cost of disclosure and registration is outweighed by the benefit of protection bestowed to investors.

For example, Gary Gensler, Chairman of the US Securities and Exchange Commission, reiterated that the Howey Test, (a standard brought by the US supreme court in 1946 to determine whether there is an investment contract within the scope of securities regulation) should keep applying to the crypto market to protect investors. Similarly, the Australian Securities & Investments Commission published an information sheet (INFO 225) to regulate crypto asset businesses under the existing legal regime. As a result, when a business is involved with crypto assets in Australia, the business owner likely has an obligation to register with the Australian Securities & Investment Commission to disclose relevant information.

On the other hand, a strong self-regulatory regime of the crypto industry is an alternative approach to better protect investors.

The modern financial regulation system relies on the disclosure mechanism, a result of the Great Depression era from 1928–1939. Forcing the diverse crypto industry to act like traditional financial institutions as if they were in 1939 only imposes an undue burden on crypto exchanges and investors.

According to Coinbase’s Digital Asset Policy proposal, “Our financial regulatory system is predicated on the ongoing existence of a series of separate financial market intermediaries — exchanges, transfer agents, clearing houses, custodians, and traditional brokers — because it never contemplated that distributed ledger and blockchain technology could exist.”

On the other hand, crypto service providers should work together to make every effort to prevent financial crime, including fraud, tax evasion, and money-laundering activities. Such a strong self-regulatory regime will create a win-win-win situation between investors, regulators, and crypto service providers because it lowers regulatory and transactional costs.

III. Business promotion and crime prevention

Governments compete with each other for capital and human resources when it comes to business promotion, including crypto policy.

Such policy usually prefers to treat crypto assets like commodities and seeks private actors’ cooperation in taxation and anti-money laundering.

For example, the newly-elected mayor of New York City, Eric Adams, said he would take his first three paychecks in Bitcoin and issue NYC cryptocurrency to wager “friendly competition” with the city of Miami, which has issued MiamiCoin. In contrast to the securities commission whose goal is to protect investors, Mayor Adams promised to remove red tape that prevents “the growth of Bitcoin and cryptocurrency in [New York City].”

The public-private partnership is more likely to be established for the purpose of business promotion and crime prevention.

Thailand officials, for example, are currently collaborating with crypto exchanges to provide crypto payment solutions for tourists.

“If Thailand is looking to recover about 80% of its pre-pandemic tourism revenue in 2023 but with half the number of foreign tourist arrivals we saw in 2019, we can achieve that by getting someone like Russell Crowe or a crypto holder like Tim Cook to travel here,” Yuthasak Supasorn, tourism board governor told Bloomberg.

Additionally, blockchain companies like XREX are partnering with officials and regulators from governments and banks to help small and medium-sized enterprises utilize blockchain technology to promote and accelerate cross-border business.

By the same token, taxation and financial crime compliance agencies work closely to require the disclosure of crypto activities. Because their main goal is to collect taxes, detect and deter unlawful transactions, there is no need to impose an undue burden on individuals or entities in the crypto world.

For example, since 2014 the US Internal Revenue Service has treated virtual currencies like Bitcoin as property and thus “taxable by law just like transactions on any other property.” Thus, public and private partnerships can significantly help achieve this goal.

Wayne Huang, CEO of XREX, has reiterated in a recent letter that “compliance is a long run…[and] XREX is not serving bad actors.”

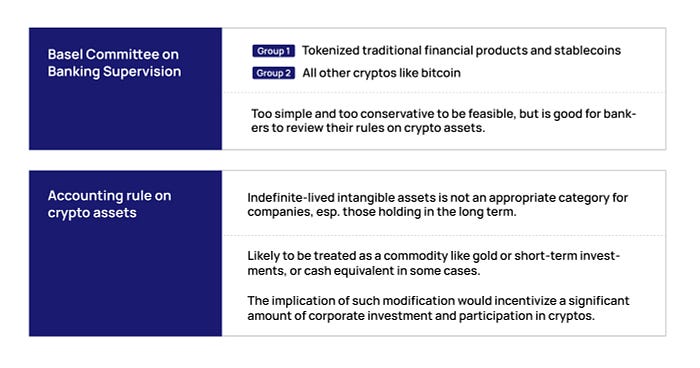

Industrial standards or proposals: The call for crypto accounting rule modification and Basel Committee

While crypto assets gained more acceptance and exposure in 2021, the accounting rule is still silent. In practice, Bitcoin and other cryptocurrencies are considered “indefinite-lived intangible assets.” That is, companies holding crypto assets have to reevaluate their crypto assets at least once a year; if the value falls, they should update it accordingly. However, if the value increases more than the purchase price, they have to wait until they sell crypto assets in order to reflect their increased value in financial statements.

For example, Tesla purchased its Bitcoin at the price of about $35,000 and took a profit loss of $23 million USD in the second quarter of 2021. However, even though the market value of Bitcoin bounced back to a record high of $69,000 in November 2021, Tesla could not reflect its value in the financial statement unless it sold its Bitcoins.

This is just the tip of the crypto accounting iceberg. Such imprecise financial disclosures will likely remain a challenge in 2022 for accountants and the business world. The call for a change is becoming so loud that modification must be around the corner.

In addition, banking regulations have been shaping crypto assets, and vice versa. Global standard setter for banking regulation Basel Committee on Banking Supervision (BCBS), issued its first consultative paper in June 2021. This paper proposes three general principles:

(1) Risk-based treatment (same risk, same treatment)

(2) Simplicity (prudential treatment should be simple)

(3) Minimum standard (any committee-specified prudential treatment of crypto assets should be minimum so that specific jurisdiction can impose higher restrictions on banks as it sees appropriate)

In detail, the paper sets up two groups:

Group 1 — Tokenized traditional assets, including stablecoins

Group 2 — All other crypto assets, including Bitcoin.

BCBS has a more risk-tolerant view on Group 1, which can be addressed under Basel II with additional guidance, while Group 2 imposes a unique risk and is subject to a new conservative prudential treatment.

Interestingly, although traditional banks often consider crypto assets scams or bubbles, most of them strongly oppose BCBS’s proposal to restrict banks’ exposure to crypto assets.

For example, a joint comment by officials from six global financial associations emphasizes that banks’ involvement in the crypto asset market can “reduce operational risk and volatility and increase transparency.” Their comments show bankers’ interest in crypto assets and the crypto market’s potential.

Conclusion

The year 2021 was the pivotal year for rule-making in the crypto world because crypto came into our daily lives on a larger scale and likely will remain so in the year 2022.

It is unlikely that there will be a definite rule governing all crypto assets or crypto investments in 2022 because not all tokens or coins are created equal — the BCBS’s proposal for two groups of crypto assets is too simple to be feasible.

Regulators will seek a balance between investor protection, financial stability, and business promotion in the rule-making process. As a result, it is more likely to regulate crypto-related activities such as crypto assets custody business or specific crypto assets, based on the rights associated with such crypto assets.

From the private actors’ perspective, it is time for accountants and banking officials to review their current regime. A tailored regime for crypto assets creates a better environment for everyone, including bankers, investors, corporates, and consumers.

The first step we can take when crypto meets the physical world is to get rid of the crypto stigma. No matter if it’s in the form of commodity, currency, or financial products, crypto assets have become an unavoidable part of our real lives, and will remain well into the next generation.

Author: Jason Lai, Senior Compliance Operations Officer at XREX Inc.

—

Disclaimer:

XREX is not authorized to give tax or legal advice and this blog should not be viewed as such. For questions relating to your specific situation we strongly recommend speaking with a qualified professional in your jurisdiction.

—

A Mandarin version of this article can be found here: 2022 年數位貨幣監管趨勢:加密資產是「商品」、「貨幣」還是「金融產品」?