As you step into the world of cryptocurrencies, starting with spot positions is a common first move. Spot trading, which involves buying and selling cryptocurrencies directly, is an easy starting point. With Bitcoin’s halving on the horizon, more traders are considering extended spot holdings for potential profits.

To accommodate professional traders’ needs and continuously build friendly tools for users to increase efficiency in Trading, XREX introduced Margin Trading in the latest release.

XREX’s Margin Trading feature builds upon the simplicity of spot trading. Here, you can utilize cryptocurrencies in your holding (currently supporting only USDT) as collateral to open long or short positions through margin trading. This enables you to enhance your trading capabilities and multiply your trading power up to 3 times. Please note that Margin Trading contains a risk associated with using leverage. We recommend users who have accumulated a certain extent of trading experience and have acquired a basic trading understanding to use this feature.

To strengthen awareness of risks and convey the right spirit behind this new feature, XREX’s Margin Trading includes a “Cooling-off period”. These features help users not only maximize their trading potential but also manage their emotions while trading, making it easier to plan transactions and manage positions.

Spot Trading with Leverage: Amplifying Trading Power

Spot trading involves holding cryptocurrencies to benefit from their price changes. With a maximum of 3 times leverage, you can use less capital to control more crypto assets and triple your trading power. ” It is important to note that while Margin Trading can enhance trading efficiency and assist users to better execute their strategies, it also comes with inherent risks.

Cooling-off Period: Regulating Emotions

Even experienced traders can let emotions drive their decisions, especially during volatile market times. Based on your trading behavior over the past 72 hours, XREX would recommend whether you should turn on the “Cooling-off period” feature. It gives you time to reflect calmly, preventing impulsive trades and reducing unnecessary risks.

To learn more about XREX’s Margin Trading services:

User Guide

- XREX provides a user-friendly trading guide, including a “Margin Trading Assessment” to help you understand the features and risks involved, with an intuitive user interface on the XREX app and step-by-step illustrations. We aim to make it easy for you to start trading!

- Users must complete the “Margin Trading Assessment” before proceeding to open Margin Trading orders.

- For details about supported currency pairs, trading fees, margin costs, and other margin trading-related fees, please refer to the link.

Cooling-off Period

- Setting a cooling-off period allows you to reconsider your trades and assess the risks involved.

- If you’ve experienced multiple liquidations or collateral additions in the last 72 hours, we’ll prompt a notice to recommend a cooling-off period.

- During this time, you won’t be able to make margin trades, but you can still adjust your collateral.

Margin Cost

- XREX charges margin costs when your trade executes.

- Margin costs are calculated based on the borrowed asset type and its current value, billed hourly during the borrowing period. For periods less than an hour, it’s calculated as one hour.

- For detailed information about margin costs, please refer to the link.

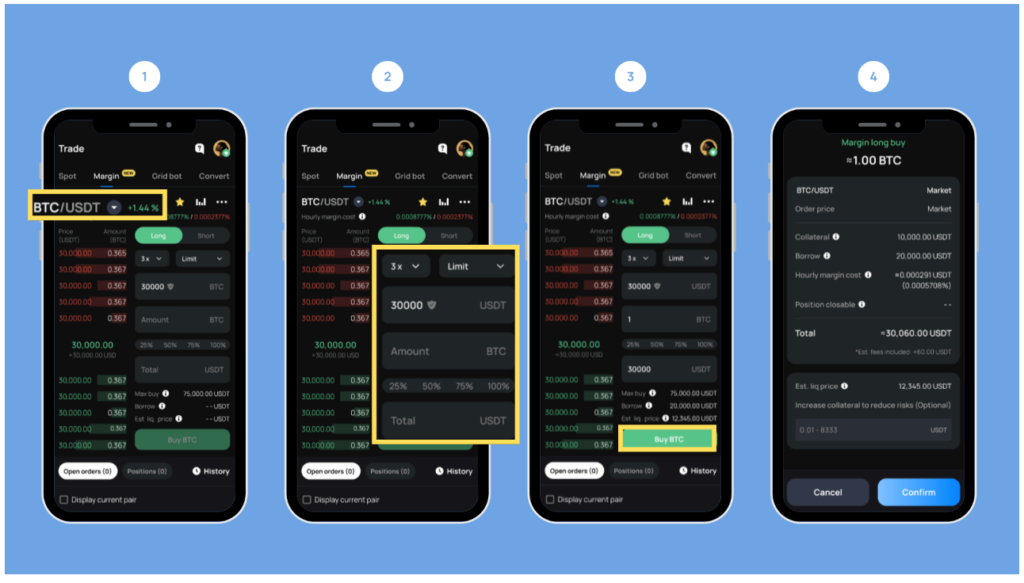

How to create a long position

- Choose the pair you want to trade.

- Fill in the desired leverage, order type, and amount.

- Click the buy button.

- Review the details and then click “Confirm” to open your position.

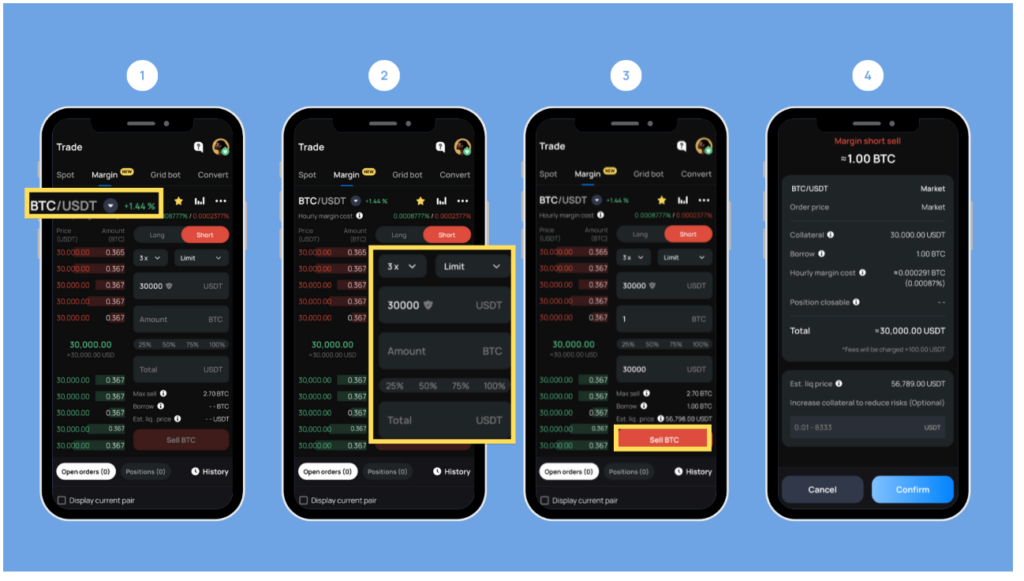

How to create a short position

- Choose the pair you want to trade.

- Fill in the desired leverage, order type, and amount.

- Click the sell button.

- Review the details and then click “Confirm” to open your position.

The XREX team will continue to launch more features to provide the safest, cleanest, and smoothest cryptocurrency trading and blockchain financial services. Learn more about XREX, welcome to the XREX Facebook community、XREX Telegram Group、XREX official website.

Welcome to download the XREX app: exchange.xrex.io/app

If you have any questions, please contact customer service on the XREX app or email support@xrex.io, and we will serve you wholeheartedly.

###

About XREX

XREX is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. We provide enterprise-grade banking services to small to medium-sized businesses (SMBs) in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018 and operating globally under multiple licenses, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.